Is your auto repair shop struggling to turn a profit? Use these financial tips from the Director of MoneyWrench to avoid the following common mistakes.

- Your shop management software doesn’t match your bookkeeping software.

- You don’t look at your financials often, or ever!

- You aren’t paying yourself properly.

- You treat your business cash as if it’s a personal bank account.

- You aren’t planning wealth transfer effectively.

Running an auto repair shop takes hard work and mechanical know-how. You possess the skills to diagnose and fix all types of vehicles. You know how to provide reliable auto repair services customers can depend on. But are you so busy working to grow and sustain the business that you’ve lost sight of your auto shop’s revenue and profitability goals?

To make informed decisions about growing revenue or expanding their business, auto repair shop owners need to understand and regularly track their financials, says Bryan Machacek, CPA and owner of accounting firm ejdm and Director of MoneyWrench.

With over 20 years of experience helping auto shop owners understand their accounting needs, Machacek says he often hears business owners say: “I can’t stand reviewing financial information. I just want to get back under the hood. This is what I hired an accountant for.” That kind of mindset can lead owners into making mistakes with their business finances.

“The truth is, many people fear finances,” Machacek says. “Ultimately as a business owner, it’s your business and your responsibility. You need to take that responsibility and educate yourself.”

In a recent webinar hosted by AutoLeap, Machacek outlines 5 common mistakes auto shop owners make that can impact your bottom line.

Mistake #1: Your shop management software doesn’t match your bookkeeping software

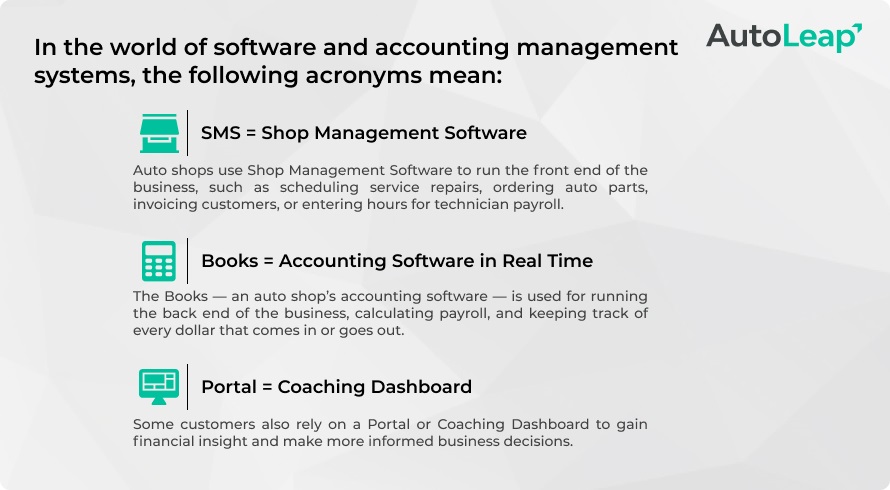

For starters, it’s important to understand the common language involved when using auto repair shop software to run your operations.

It’s best to integrate SMS and Books on a cloud-based software platform to see data in real-time, Machacek says, since many people who use the front-end software don’t always communicate with the back-end accountants. And if you’re inputting wrong or out-dated profit margins into your portal based on a certain number of jobs each month, that can lead to lost revenue.

Auto repair shops that only run desktop versions of their accounting software (no cloud access) take longer to set up since they require sending and restoring backup files, which can take several days. In the meantime, your bookkeeper has been pumping transactions into your desktop software and the information in your backup files no longer matches.

“Now we’re talking about two different sets of books, different languages, and potential problems,” Machacek says. “With the desktop version it can still work, but it’s harder for me to interact with my clients. The cloud just allows me access to get onto the system at a moment’s notice and see exactly what the client is seeing and doing.”

A common discrepancy often occurs when the SMS doesn’t equal the Books. For instance, an auto shop owner might set margin targets for the team to hit on parts, but when they check the SMS, it shows a 50% margin on parts, while the Books only show 40%. Which is correct?

“We do see this quite frequently with new clients who on-board,” Machacek says. “Maybe they haven’t looked at this before or it’s the first time they’re hearing about it.”

On the labor side, maybe you award a bonus to an auto technician and run it through Books, but not through SMS on a margin level. Or maybe employees aren’t invoicing parts correctly, or parts are walking out the door due to theft.

Discrepancies do come up, and variances generally mean there are issues somewhere, he says. Those issues may not impact your company’s financial outlook, but they could.

“It’s never going to be perfect, but if you’re talking about seven, eight, nine, ten points of discrepancy, that’s something that you should be looking into and at least figuring out what the reason for it is,” the CPA says. “A 10% spread in margin could mean thousands of lost dollars to you—or it might not be indicative of a real problem, just a variance discrepancy that you need to identify.”

TIP: Conduct a monthly review of your real-time books for the most accurate financial picture.

Mistake #2: You don’t look at your financials often, or ever!

Many auto shop owners hire accountants to handle their finances, because they simply don’t understand that side of the business. They prefer to look at their financials only when they need to, such as when they bring information to the accountant at the end of the year to prepare financial statements and tax returns.

Traditionally, accountants might review the information, show you a few areas where your margins might be slipping, then send you on your way to prepare to do it again next year.

“That type of review is far too infrequent,” Machacek says, especially since much of the information is nearly a year old and it’s too late to take any corrective actions. “This leads to poor decision-making, or perhaps no decision made, and potentially lost dollars to you. Ultimately owners need to understand where it went right or wrong.”

Auto shops depend on their financial statements to measure success, particularly when the auto repair shop owner wants to scale back, plan for retirement, and not be in the shop all day every day.

“When you’re at the shop on a day-to-day basis, you can feel, hear, and see the blood, sweat and tears going on. You understand how busy you are,” Machacek says. “If you’re removed from that and you’re not seeing that, it’s the financial statements that are ultimately going to be indicative of how the business is doing.”

For instance, maybe your auto repair sales increased last month, but cash flow seems tighter than ever. Why is that? It could be due to several reasons, but you’ll never understand why if you don’t regularly review your financial statements, and ultimately take corrective actions.

Work with a great accountant who explains things to you, helps to educate you, and works to help you understand how much revenue you made, where the money went, and how to keep more profits. An accountant who offers consistent communication to clients works best.

TIP: Take charge, review often, question always, and work with a great accountant.

Mistake #3: You aren’t paying yourself properly

The beauty of owning your own auto repair shop means you can set your own salary and the amount of rent you pay (if you own the building), but it’s also easy to overlook the needs of the business and yourself if you fail to find the right mix.

For instance:

An auto repair shop owner might set the building rent based on how much it costs to cover the monthly mortgage payment, property taxes, and utilities. In another instance, the owner may have no mortgage payment and simply sets the rent to cover property taxes and utilities, at an amount much less than fair market value.

If the owner in the second example goes to sell his auto shop business, Machacek says, the Books might show he pays $500 a month for rent, rather than the true market rent value of $4,500 per month—a drastic increase, previously undisclosed, that can negatively impact any future sale of the business.

Knowing how much to pay yourself or what amount to set for rent depends on where you’re at in the life cycle of your auto repair shop business, Machacek says.

“If I’m a new shop owner and maybe cash is tight, I can’t afford to actually pay that market value rent and maybe I want to do it gradually, but if I’m a couple years from the potential sale of my business and I’m looking to exit, I want to be doing that right away because I want to be showing a solid couple of years of sustainable profitability at the right numbers,” Machacek says.

TIP: Plan your pay annually, considering all of your business and personal needs.

Mistake #4: You treat your business cash as if it’s a personal bank account

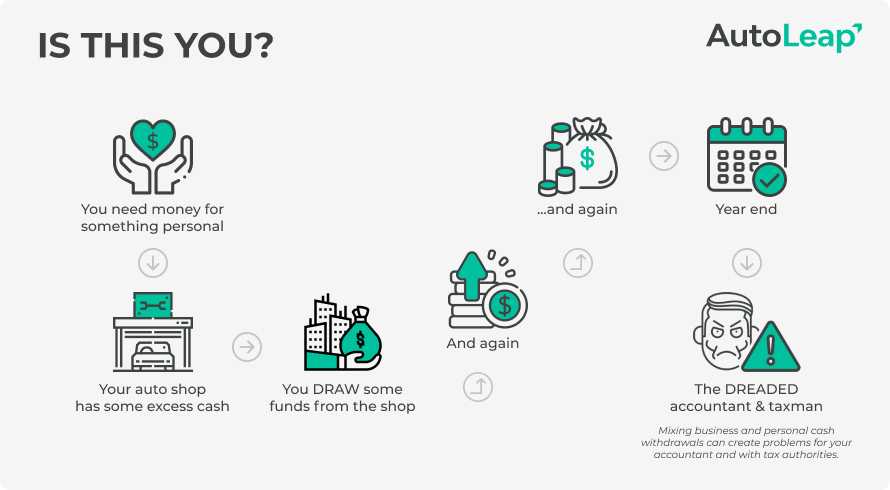

As an auto shop owner with access to all of the company’s assets, it can be tempting to tap into the business cash sometimes when you need money to pay for something personal.

“Maybe you want to take the family on a vacation to Maui or something and you don’t have that money in your bank account, but your shop does, so you draw some funds from the shop,” Machacek says. “Oh geez, that was easy. Now you need a new TV or your boy needs a new dirt bike … and we do it again and again and again.”

“Then all of a sudden, we get to the end of the year and the dreaded accountant and taxman show up,” he adds. “Drawing excess funds out of our corporation, outside of our remuneration plan, can get you into trouble. You don’t want to do this.”

Machacek says it’s important to draw a line in the sand between business and personal funds to avoid the following problems:

“I’ve been in this for longer than I want to admit and I’ve seen the horror stories of people mixing business and personal back and forth,” Machacek says. “It can be a nightmare, it’s frustrating, and the professional fees add up. We’re trying to sift through every little expense and it’s costly to clean up that mess.”

TIP: Keep your personal life out of the shop with discipline, and stick to your pay plan.

Mistake #5: You aren’t planning wealth transfer effectively

Are you planning to sell your auto repair shop to set yourself up for retirement? For most shop owners, the answer is yes, but proper planning may never occur.

“Decades go by, seemingly in the blink of an eye. You may think, ‘I got a lot of time to plan for this,’ and all of a sudden you wake up and you’re 55 years old and you haven’t put any money aside, or you haven’t set up the business for a solid transfer to maybe a child or a sale to an arm’s-length party,” Machacek says.

Now’s the time to plan for retirement, and try to gain a clearer picture of your company’s worth.

“I think that’s really the dream that we all have when getting into a business. We don’t want to be busting ourselves and working a 12-hour day. We want to have something that’s going to help us grow, contribute to our families, and give us that life that we always wanted,” Machacek says.

Shops are typically sold for a multiple of EBITDA (Earnings Before Interest Taxes Depreciation and Amortization), so it’s important to ask your accountant what that multiple currently looks like for your business. Some other things to consider include:

- If the sale of your auto shop won’t sustain you in retirement, you’ll need some other way to earn income. Do you currently have tax-deferred savings to complement your retirement plans?

- Purchasers of your auto shop don’t want to buy a job, they want to buy a business. Have you set up processes and procedures so your shop can run successfully without you?

- Get your finances in order well in advance of a possible sale to show several years of solid sustainable growth. Are you reviewing financial statements on a regular basis?

- Are you contributing funds to a tax-deferred retirement plan? This is a great option to gain a taxable deduction right out of the gate and easily grow your retirement income.

“There are many things needed to run a good solid business: the processes, the data, the vision of the business. All those things need to come together. You need good, solid data you can rely on to make those good decisions.” Machacek says. “You shouldn’t be running your shop by just looking at your bank account. You’ve got to fully understand the data, you need to have your systems talking and aligning, and you need to be working with somebody who can help you.”

TIP: Contribute to retirement accounts early and often, and build your systems and processes to allow the shop to work without you.

Did you find this blog post informative? Leave your thoughts here!

Auto Repair Shop Management Software

AutoLeap is a powerful all-in-one auto repair shop software that helps to keep complete track of your business – from scheduling appointments to managing technicians and generating invoices.