Managing auto shop payroll can be complex and time-consuming. You have to ensure employees are paid accurately and on time. You also need to maintain compliance with federal and state regulations.

This guide will help auto shop owners understand the fundamentals of auto shop payroll. It will help them set up an efficient payroll system, and avoid common pitfalls.

Understanding payroll fundamentals

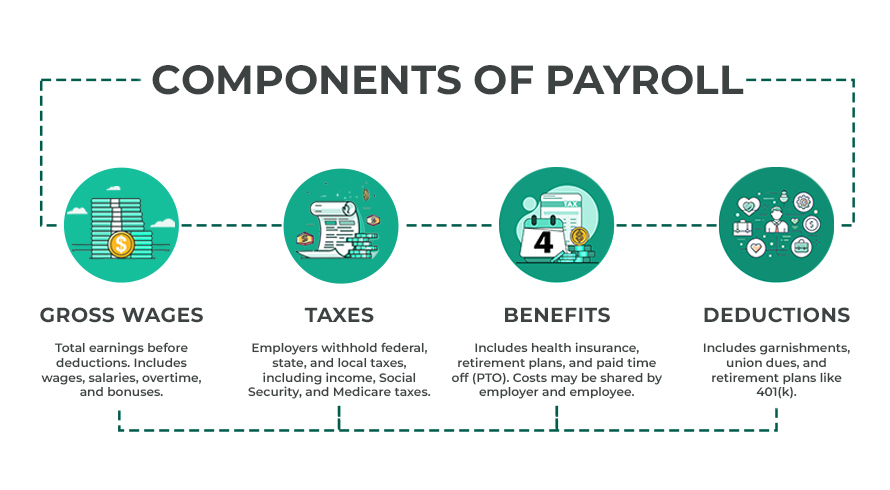

Payroll is the process of compensating employees for their work. It includes wages, taxes, benefits, and deductions. For employers, it helps with legal compliance and employee satisfaction. For employees, it guarantees timely and accurate payment for their services. The following are some components of payroll.

Gross wages

This is the total amount an employee earns before any deductions are made. It includes hourly wages, salaries, overtime pay, and any bonuses or commissions.

Taxes

Employers are responsible for withholding federal, state, and local taxes from employees’ paychecks. This includes income tax, Social Security tax, and Medicare tax. In addition to withholding, employers must also pay a portion of Social Security and Medicare taxes.

Benefits

Employee benefits include health insurance, retirement plans, and paid time off (PTO). These are often deducted from gross wages. The cost of these benefits may be shared between the employer and the employee.

Deductions

Other deductions may include garnishments, union dues, and contributions to retirement plans like 401(k).

Setting up a payroll system

Auto shop owners have a choice between manual processing or automated payroll systems.

Manual payroll processing

This method involves calculating wages, taxes, and deductions by hand or using spreadsheets. It may seem cost-effective, but it is labor-intensive. Due to this, manual payroll processing is prone to errors and can be time-consuming. Especially when your business is growing.

Automated payroll systems

Automated payroll systems streamline the process by automatically calculating wages, taxes, and deductions. Needless to say, it is done with automated payroll software. This also keeps records, generates reports, and ensures tax law compliance. Yes, there is an upfront cost. But, the time savings and accuracy often make automated systems a better choice for most auto shops.

Essential records maintenance

Proper record-keeping helps with compliance and operational efficiency. Auto shop owners should maintain the following employee records:

- Employee Information: Personal details, job titles, wage rates, and start dates.

- Timekeeping Records: Accurate records of hours worked, including regular hours, overtime, and PTO.

- Payroll Registers: A detailed report of each payroll period. This shows gross wages, deductions, net pay, and tax withholdings.

- Tax Records: Copies of all tax filings. This includes W-2s, W-4s, and 1099s for independent contractors.

Payroll compliance for auto repair shops

Auto repair shops must comply with a range of federal and state regulations, including:

Tax obligations

Employers have to withhold federal and state income taxes. This also includes Social Security, and Medicare taxes from employee wages. Additionally, they must pay their portion of these and unemployment taxes.

Minimum wage laws

Employers must pay at least the federal or state minimum wage. Whichever is higher. Some states have higher minimum wage requirements. Those must be followed.

Overtime rules

Under the Fair Labor Standards Act (FLSA), non-exempt employees must be paid overtime. This is at a rate of 1.5 times their regular hourly wage for hours worked over 40 in a workweek.

Record-keeping

Employers must maintain accurate payroll records for each employee. This includes wage rates, hours worked, and deductions, for a minimum of three years.

If your auto shop fails to adhere to payroll laws, it can lead to penalties. These include fines, back pay, and legal action. Non-compliance can also damage an auto shop’s reputation and lead to employee dissatisfaction.

Steps in payroll processing

Accurate payroll processing includes the following steps:

Hourly wages and salaries

Multiply the employee’s hourly rate by the number of hours worked. For salaried employees, divide their annual salary by the number of pay periods.

Overtime

Calculate overtime by multiplying the regular hourly rate by 1.5 and then multiplying by the number of overtime hours worked.

Commissions

Add any commissions earned during the pay period to the employee’s gross wages.

Deduction management

Common payroll deductions include:

- Withhold federal and state income taxes based on the employee’s W-4 form.

- Deduct the employee’s portion of Social Security (6.2%) and Medicare (1.45%) taxes.

- Deduct the employee’s share of health insurance premiums.

- Deduct contributions to retirement plans like 401(k).

Paycheck issuance

Auto shop owners can choose between issuing physical paychecks or using direct deposit. Direct deposit is typically preferred. It is faster, more secure, and reduces the risk of lost or stolen checks. It also simplifies record-keeping by automatically creating electronic records of each transaction.

Benefits and compensation management

Health insurance premiums

Deduct the employee’s portion of health insurance premiums from their gross wages. You can also pay the employer’s portion directly to the insurance provider.

Retirement contributions

Deduct contributions to retirement plans. Also ensure they are deposited into the appropriate accounts on time.

Bonus and incentive integration

Incorporating bonuses and other incentives into payroll can motivate employees and reward performance. Make sure all bonuses are calculated accurately. And include it in the employee’s gross wages for tax purposes.

Payroll software solutions for auto repair shops

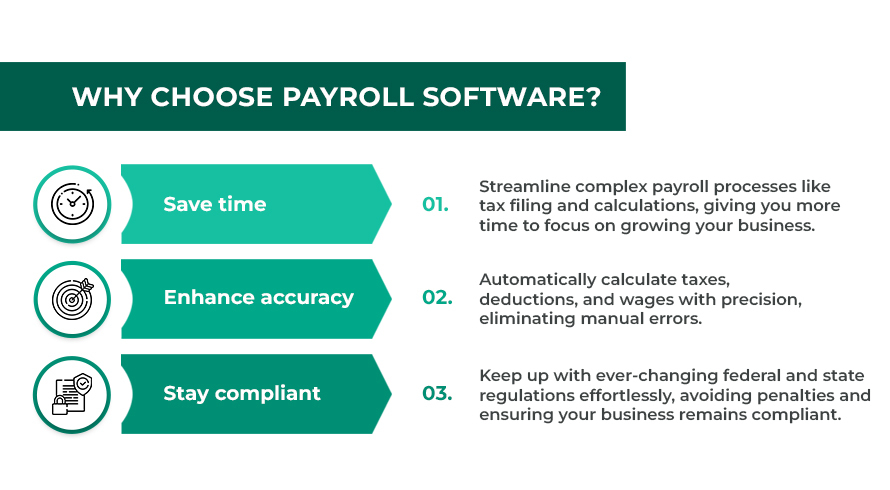

Benefits of Payroll Software

Time Savings

Automated payroll systems reduce the time spent on calculations, record-keeping, and tax filing.

Accuracy

The software minimizes errors by automatically calculating taxes, deductions, and wages.

Compliance

Many payroll systems include features that ensure compliance with federal and state regulations. This helps reduce the risk of costly penalties.

Software recommendation

For small to medium-sized auto repair shops, consider the following payroll software options:

QuickBooks payroll

QuickBooks Payroll is a popular choice for small businesses. It offers integrated accounting and payroll services. Leading shop management software also integrates with QBO, providing you with an all-in-one solution.

Gusto

Gusto is known for its user-friendly interface. It is also popular for its comprehensive payroll and benefits management features.

ADP

ADP offers scalable payroll solutions with advanced features for larger auto shops.

Common payroll errors and prevention

Common payroll mistakes include:

- Incorrectly or misclassifying classifying employees as exempt or non-exempt. This can lead to overtime violations.

- Errors in tax withholding can result in penalties for both the employer and the employee.

- Failing to meet tax filing or payment deadlines can result in fines and interest charges.

To avoid payroll errors:

- Use payroll software as an automated system reduces the risk of calculation errors and ensures timely tax filings.

- Keep up-to-date with changes in payroll laws and regulations.

- Regularly review payroll entries for accuracy before issuing paychecks.

Wrapping up

Effective payroll management means your auto shop is operated smoothly. For this, understand the payroll fundamentals. Also set up an efficient system, ensure compliance, and use payroll software.

This will help you streamline the process and avoid common pitfalls for your auto shop. Invest time and resources into proper payroll management. This will lead to a more satisfied workforce and a more successful business. Manually doing it all might save you money, but will cost you in the long-run.