» Want to grow your auto repair business? Click here to schedule a demo.

In a webinar hosted by Autoleap.com, a leading auto repair software, Chris Cotton of AutoFix talks about how important it is to make sure you understand the numbers when running or purchasing a business. Understanding the financials will let you know exactly where you stand and allow you to make decisions at the right time, so it’s essential to know which metrics to look out for.

Key skills an auto repair shop owner should possess

Business owners must possess specific skills to ensure their shop runs smoothly. Some of these skills include:

- Knowledge of point of sale (POS) numbers: If someone asks you about the sales figures for your shop last month, you should know them off the top of your head.

- Great set of KPIs: Your key performance indicators (KPIs) will help you set a goal to reach and track your progress over some time, letting you know if your shop is doing well.

- Accurate and updated financials: As a shop owner, knowing the financials of your shop is key, and it’s hard to keep track of that when you don’t have accurate or updated financial statements.

- Communication skills: Communication skills can be convenient not only for communicating with your team but also when dealing with unhappy customers that come into your shop.

- Leadership skills: You’ll have multiple techs and office employees working under you and looking at you for guidance. Good leadership skills will ensure your shop stays running smoothly and that your employees are happy.

- Ability to coach others: Techs might come to you and want advice regarding a job; some may even be looking for mentorship. You must be able to teach others what you know to help them and decrease the tasks you have to do.

Point of sale (POS) systems

To make operations a lot more smooth, Cotton recommends having a point of sale (POS) system in place for your business. “It doesn’t matter what the cost is; once you put in a parts matrix, labor…digital vehicle inspections (DVI) alone will help you increase your average repair order by about $242.”

It’s also essential to make sure the figures on your POS, income statement, and KPI tracker are synced up and there’s no discrepancy. If there is a discrepancy, you won’t be able to have the updated numbers on at least one sheet, which can significantly affect the information you work with. If your ARO goal is $800, but your average estimate is $600, you likely won’t be able to achieve your goal. Here are a few things to keep in mind:

- Does the income statement reflect parts cost: There can be several reasons this can’t happen, such as not returning cores, the ongoing parts issue, or a communication issue between the front counter and the manufacturers. Make sure you get to the heart of the problem.

- Are all costs of goods sold put into the POS system: Anything that would go in your cost of goods sold section should also go in your POS system. This simple yet effective rule will ensure no discrepancy between the balances in each and ensure you have the most accurate and updated information

- Include technician tax and benefit load: Your POS system should also track any tax and benefit loads for your technicians. If your tech earns $30 an hour, your POS should not show the same $30 in the system but a higher amount to reflect the tax and benefit load. “A lot of times, people call us saying, ‘Chris, our numbers don’t add up,’ and when we look into it, this is where the problem lies.”

Income Statement

Making an income statement for a business might seem straightforward, but you’d be surprised how some practices can completely change how you’d make one. Here’s how you can effectively adjust segments of your income statement.

Sales

When putting in the sales figure on your income statement, make sure that you can show the breakup of each source of revenue. As an auto repair shop, you’ll have five main categories of sales:

- Labor sales

- Parts sales

- Shop supply sales

- Tire sales

- Sublet sales

Along with these five accounts, make sure you have a cost of goods sold (COGS) offsetting account for each, namely:

- Labor

- Parts

- Shop supply

- Tire

- Sublet

You’ll have to adjust this list to ensure your business revenue sources are listed here. For example, if your shop offers towing services, make sure to include that in your sales figure. . Just make sure that all your accounts are synced up to avoid discrepancies.

Cost of goods sold (COGS)

When showing your financials to a stakeholder, make sure you have percentage values for each relevant metric for easy comprehension. An auto repair software with built-in QuickBooks integration will allow you to do this with a button click.

When showing a statement about a particular business segment, make sure they get put in COGS. For example, any freight costs paid for procuring parts are costs you incurred doing business and will go in your COGS instead of expenses.

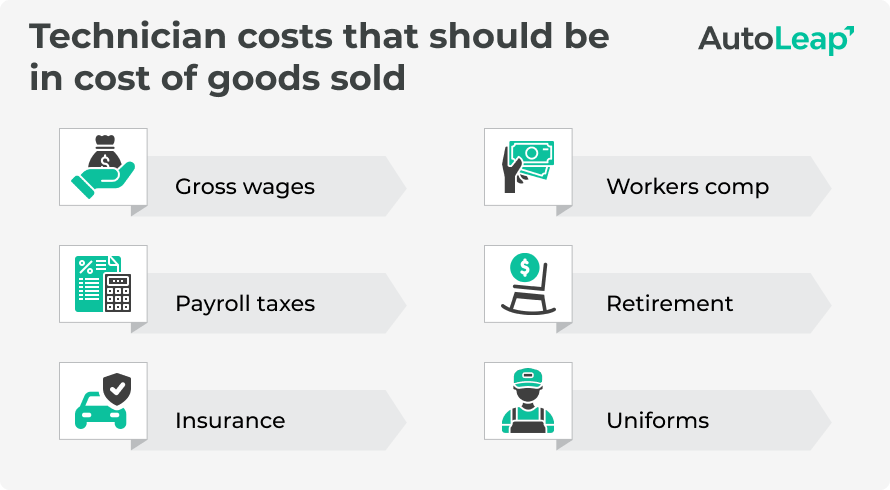

Similarly, any expenses that pertain to your technicians, such as payroll, uniforms, education, health insurance, etc., need to be split up and moved to your cost of goods sold. Remember to split up these costs, so you’ll know precisely what your margins are when you look at the financials.

If done right, your labor cost of goods sold should include the following information about your staff members:

This format should follow for technicians, service writers, and anyone in your employ. Whatever you do to benefit your employee should be considered a cost of doing business and go into the cost of goods sold.

Now that your POS system and income statement are in sync, time to focus on KPIs.

Key performance indicators (KPIs)

We’ve talked about tracking your KPIs effectively, but what are the most important metrics to track? According to Cotton, here are five metrics to look out for:

- Average estimate size: Estimates determine the business revenue you can generate at a point, which ties into the other metrics.

- Closing ratio: Closes can boost the amount of business your shop gets, so look to increase them.

- Average repair order: Any shop should look to maximize their ARO as much as possible.

- Gross profit margin: The ideal gross profit margin should be 65% or above.

- Net profit margin: Your net profit margin should ideally be 25% or better.

Once you’ve set up your finances correctly, you can start using KPIs to effectively track your performance over time, ensuring your shop meets its goals without any hindrance.

Closing thoughts

Running a shop successfully requires a proper understanding of the financials of your business, and only when you understand them fully can you start improving your business. As a shop owner, your goal should be to have the most updated and accurate information possible and to ensure a streamlined process throughout.

Demo

Demo