Retirement planning is an inevitable step for an auto shop owner. According to Autoleap’s Industry Benchmark Report, 64% of auto shop owners are expected to retire in the next 10 years. Unfortunately, retirement is never easy for a shop owner. It carries a unique set of challenges and considerations for them.

Schedule a free demo today!

Boost your shop sales

Simplify shop management

Empower your technicians

Potential pitfalls of not building a retirement plan

Financial insecurity in retirement

Without a solid retirement plan, financial insecurity can become a harsh reality. Shop owners often invest most of their time and resources into their businesses. They sometimes neglect their retirement savings. This can lead to insufficient funds to support a comfortable lifestyle during retirement.

Increased stress and anxiety about the future

The uncertainty of not knowing if you’ll have enough money to retire can cause significant stress and anxiety. This stress can negatively impact your health and overall well-being. Both now and in the future. Planning can help alleviate these worries. It will also provide peace of mind and a clearer path forward.

Limited options for business succession or sale

Failing to plan for retirement also means you may not have a clear strategy for what happens to your business when you retire. Whether you plan to sell your shop, pass it on to a family member, or transfer it to an employee. If you don’t have a succession plan in place, it can limit your options. It might even decrease the value of your business.

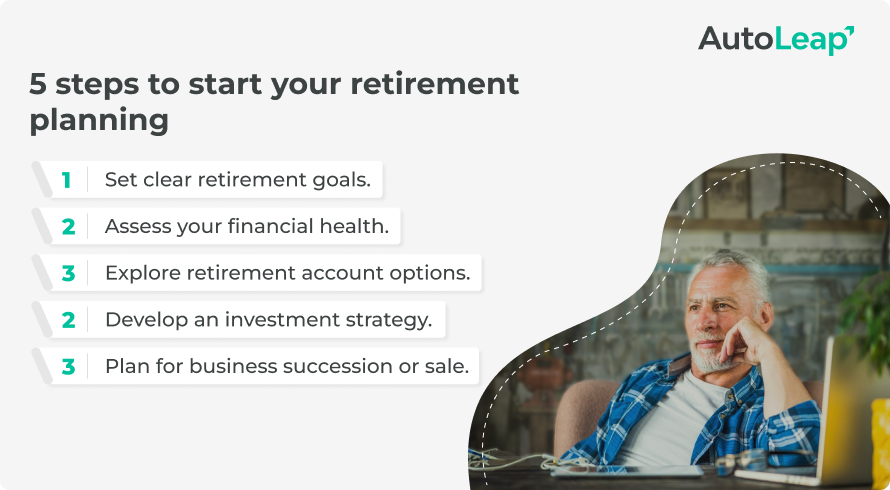

5 Steps to Start Your Retirement Planning

You need a retirement plan. And you need to start working on it well in time so you are sorted by the time you are nearing retirement. Here are five key steps you can follow to build your retirement plan.

Step 1: Set clear retirement goals

Define your retirement vision

You first have to define what retirement looks like for you. You will have to think about where you want to live, what activities you want to take on, and how you wish to spend your time. Will you be traveling? Do you plan to live a modest lifestyle? All of this means you have to envision the lifestyle you want for yourself. The answer to these questions will chart out your financial planning process and help you set realistic goals.

Determine your desired retirement age

Once you have your vision in place, you have to decide the age at which you want to retire. This decision will impact how much money you need to save.

Calculate How Much Money You Will Need to Retire Comfortably

Once you have a clear vision of your retirement, calculate how much money you’ll need to achieve it.

Here you will have to take your expected living expenses, healthcare costs, leisure activities, and any other factors into account. All these will affect your financial needs. A couple of expenses that are underestimated:

- The impact of inflation

- Health care costs

- Real estate costs

So when accounting for these costs, it is better to not stick to a conservative figure.

Step 2: Assess your financial health

Conduct a comprehensive financial review

Take a close look at your current financial situation. This is where you will review your assets, liabilities, income, and expenses in detail. This comprehensive financial review will give you a clear picture of where you stand. And you will know what adjustments you need to make to reach your retirement goals.

Identify all sources of income and expenses

Identify all your income sources. This includes your business, investments, and any other revenue streams. Similarly, list all your fixed and variable expenses. Both personal and business-related. When you understand these figures, you will be able to create a realistic budget and savings plan.

Understand your shop’s profitability

Evaluate your shop’s profitability. See if it has the potential to contribute to your retirement savings. If it’s profitable, you can use some of the profits to fund your retirement accounts. However, if your shop is struggling, you may need to improve its financial health before funding your retirement.

Step 3: Explore retirement account options

Overview of retirement accounts (401(k), IRA, Roth IRA)

There are several retirement account options available to shop owners. Each has its own benefits and limitations. Common options include 401(k) plans, Individual Retirement Accounts (IRAs), and Roth IRAs. Understanding these options will help you make informed decisions.

Benefits of each type of account for shop owners

- 401(k): Offers high contribution limits and potential employer matching if you have employees.

- IRA: Provides tax-deferred growth. This means you won’t pay taxes on your earnings until you withdraw them in retirement.

- Roth IRA: Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free, which can be advantageous if you expect to be in a higher tax bracket later.

How to choose the right retirement account based on your needs

So which of the above accounts will you choose? For this, you will have to consider three things:

- Your current financial situation

- The tax bracket

- Retirement goals

You can also consult with a financial advisor who can help you make the best choice for you.

Step 4: Develop an investment strategy

Diversify investments

Diversification of your investments will help you minimize risk and maximize returns. Spread your investments in dividend-paying stocks, bonds, real estate and other low risk assets. It will also protect your investment portfolio from sporadic and unpredictable changes in the market.

Tailor your investment strategy to your retirement timeline

Your investment strategy should align with your retirement timeline. If you have several decades until retirement, you can afford to take more risks for potentially higher returns. However, as you get closer to retirement, it’s wise to shift to more conservative investments to save your capital.

Seek professional financial advice for optimal investment choices

Consider working with a financial advisor to develop and manage your investment strategy. An advisor can provide valuable insights. They can also help you stay on track, and adjust your plan as needed. This will allow you to reach your retirement goals in time.

Step 5: Plan for business succession or sale

Have a succession plan in place

A succession plan means that your business continues to operate smoothly after you retire. It also helps protect the value of your business and provides a clear path for transferring ownership.

Explore options for selling your business or passing it on to family

Decide whether to sell your business, pass it on to a family member, or transfer it to a trusted employee. Each option has its own set of considerations and implications for your retirement.

“There is such a high percentage of shop owners that are ready for retirement or close to it. This is not surprising, but we need to work hard as an industry to train up the next generation.” – Cecil Bullard, CEO at the Institute for Automotive Business Excellence

Additional note: If you’re passing down your business to a family member or planning to sell, and you’ve managed the shop all these years manually it’s time to consider a big change. Investing in an auto repair shop management system. It centralizes and documents your business’s processes, from scheduling and invoicing to inventory and customer communication. This not only makes the shop more efficient and valuable but also sets up your successor for success.

Wrapping up

Early retirement planning can help you achieve financial security and peace of mind in your retirement years. You can start setting goals, envisioning your life after retirement, and assessing your financial health. Go ahead and explore different retirement account options and develop an investment strategy with a trusted financial advisor. By getting a headstart in your retirement planning, you can plan a comfortable and stress-free retirement. Remember, it’s never too early to start planning for your future.