Are you looking to start your own auto repair shop? Or maybe you want to expand your current business. In either case, relying on existing equity alone might not be enough to make your ambitious plans a reality.

There are many ways to get extra financing for your business. Let’s discuss a few auto repair loan options in this article so you can weigh the pros and cons before deciding which option best suits your needs.

How financing can help your auto repair business

Financing a business using credit is a practice as old as time, and there’s a good reason why. The extra capital allows you to invest in better machinery, better labor, or invest in the latest auto repair software and take your business to the next level. Financing can be the way to go if you’re looking to grow your vehicle repair shop. Let’s take a look at what financing can help a shop achieve:

- Starting a new shop: Setting up a new car repair business requires capital, and it could be difficult to finance the entire operation using equity only. You may have heard the phrase “Don’t put all your eggs in one basket” from the billionaire investor Warren Buffet, which applies here.

- Upgrading current equipment: Small auto repair shops often struggle with the high costs of essential equipment such as engine hoists, vehicle lifts, and air compressors. Using old and outdated equipment can not only be a hassle, but it can also be dangerous if not maintained properly. Getting the latest equipment will not only help you smooth your operations, but will also keep you updated with changing technology, such as Digital vehicle inspections software (DVI) and Advanced Driver Assistance Systems (ADAS).

- Expanding current operations: Owning a successful auto repair shop is an amazing milestone—so why not take it a step further? Expanding your business to have a second outlet in a different location has more benefits than just potential revenue—it can also be a very effective marketing strategy for your auto repair business.

- Scaling marketing costs: Despite being a lucrative industry, competition is fierce in the market, making it essential to effectively distinguish oneself from competitors. Having a strong digital presence is becoming increasingly crucial which is why auto repair shop loans are often used to enhance online exposure and attract more customers. Investing in a top-notch professional site and creating a strong social media presence can help establish a unique and recognizable brand identity, which can ultimately lead to more business for the auto shop.

Different financing options for auto repair shops

Looking into different types of loan offers for your business might seem like a good idea now. But what other alternatives do you have as a shop owner looking to expand your auto shop or start your own business?

Let’s take a look at three options that are worth considering:

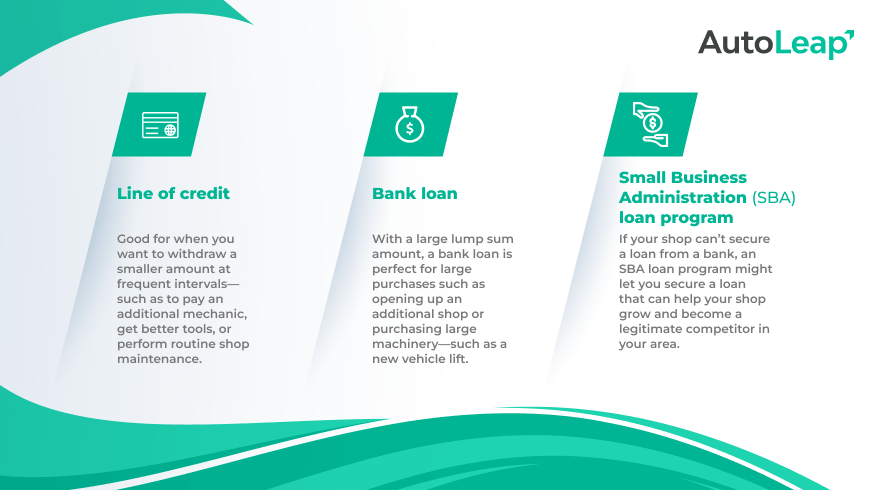

1. Line of credit (LOC)

Getting a line of credit from your bank would let you access a certain amount of funds that you can tap into at any time. These funds are often called revolving funds and offer a number of benefits for those who avail them, some of which include:

- Flexible funds: Unlike a conventional loan where a borrower gets a lump-sum amount, a line of credit allows you to withdraw different amounts at different times depending on what you need. This flexibility will make sure you never withdraw more than you need while still having a proverbial safety net for you to fall on, should you ever need extra funds.

- Replenishing amount: Any amount paid back into the LOC will replenish the overall funds available to you—provided you have an open line of credit. Knowing that you never have to worry about the funds running out ensures that you’re incentivized to pay on time and lets you worry solely about how to run your business to the best of your ability.

- Ease-of-access: Generally speaking, opening up a business line of credit will be a lot easier than most other forms of finance, especially if you have a good credit history.

Tapping into a LOC will allow you to maintain a relatively stable cash flow without having your bank statements go into the red, provided your money management is reasonable.

2. Bank loan

Everyone is familiar with a traditional bank loan, especially business owners. Generally speaking, a loan will consist of three components:

- Principal amount: This is the actual loan amount that you take from the bank that will be repaid after a set amount of time. Usually, this loan is given with strict conditions that it can only be used for one purpose—such as business.

- Loan rate: Every loan you take out has a certain interest rate that has to be paid at certain intervals. This can vary over time due to a number of factors like previous credit score history, business projections, and a lot of other factors. Make sure you acquire the right information and your loan is taken at a reasonable rate—you don’t want to end up in too much debt!

- Repayment terms: Loans have certain repayment conditions that must be adhered to, such as a 12-week or 24-week payment period. To understand and check what favorable terms are available for your car repair business, make sure to talk to your bank and choose what suits you best.

Taking out a bank loan is a popular method of financing any sort of business, and you can get very reasonable rates if you have existing business experience.

3. Small Business Administration (SBA) loan program

Some banks can set a lot of rigid rules and regulations for giving out a loan or LOC that not everyone can meet. In this scenario, the SBA loan guarantee program will sometimes allow borrowers who might not have met the requirements to be eligible for a small business loan. In particular, SBA loans for auto repair shops are known for being some of easiest small business loans to obtain.

Although the SBA isn’t a lender, loans are offered by participating banks, credit unions, and a few specially-licensed non-bank lenders.

Closing thoughts

Getting the right cash flow for your auto repair business can seem like a daunting task, but there are a number of alternative ways you can successfully secure the financing you need. Whether you need money upfront or over a period of time, finding the right program to suit your business plan is vital for your success.