Payment processing can be one of the most stressful aspects of running a business. Maybe the customer doesn’t have enough cash or their credit card doesn’t go through. Whatever the reason, this situation can prove stressful for both you and your customers. Thankfully, modern auto repair software can make this process a lot easier.

Payment methods have changed greatly over the past few years. We went from using physical cash for nearly every transaction to going almost completely cashless. From your coffee to your car, everything is paid for either digitally or with a card. It’s important that your auto repair shop is equipped with the tools to keep up with these changes. Let’s see how AutoLeap can help you do just that.

QuickBooks integration

Software designed specifically for payments, QuickBooks is the go-to for a lot of people’s accounting needs. With everything automated, all it takes is a few clicks to have all your accounting information stored, organized, and available at a glance. The best part? You can access it all right from the Autoleap application! You don’t need to sign up for any additional third-party software, saving you a lot of time and hassle and letting you get right down to business.

Different payment options

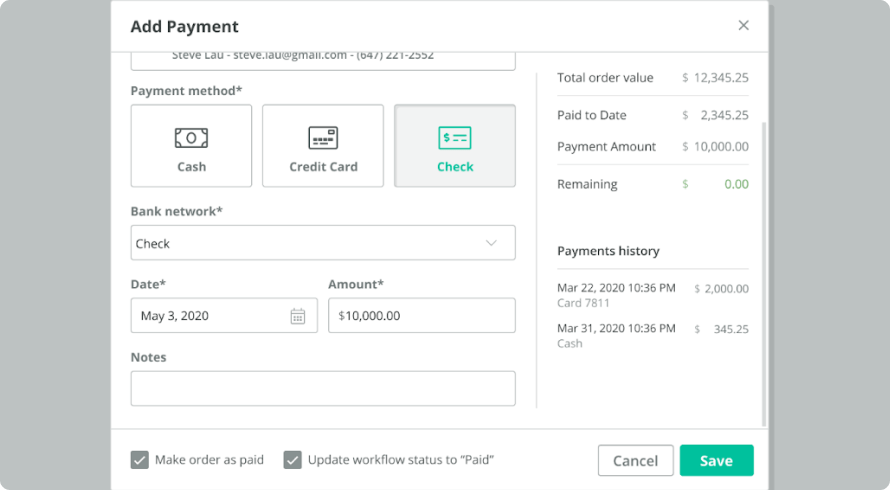

Different customers prefer different payment methods, and it’s important that you’re ready to cater to each customer’s preference as needed. Here are the most popular options:

- Credit/debit card: Credit cards are the most commonly used payment method in the US, so it’s important that you can cater to this method. Your customers can choose to enter their card details online, or swipe their card at the point of sale (POS). The transaction gets recorded and logged once the repair order (RO) has been made.

- Cash: It’s safe to assume you’ll be seeing a lot of hard cash in your shop, and we can help ensure tracking that is easier than it ever was before. Every time an RO gets punched, you can select the payment amount as cash—and that’s it! No extra steps are needed, and your books are all updated.

- Check: This is one you won’t see very often, but it’s still preferred by some customers. If a customer makes a check out to your shop, you can write out the details on the screen and secure a record of payment in the form of a picture.

A huge problem when it comes to payments is the security of the payment method. You may have once experienced cases of fraud or refund dispute requests, and we know how mentally taxing that can be. Thankfully, we have methods here that can help you out!

Secure payments

Banks and financial institutions have come a long way in payment processing security. But there might still be some cases where a fraudulent card or payment might happen, so it’s important to make sure you take steps to secure yourself from such cases. Here are two ways we can assist that process:

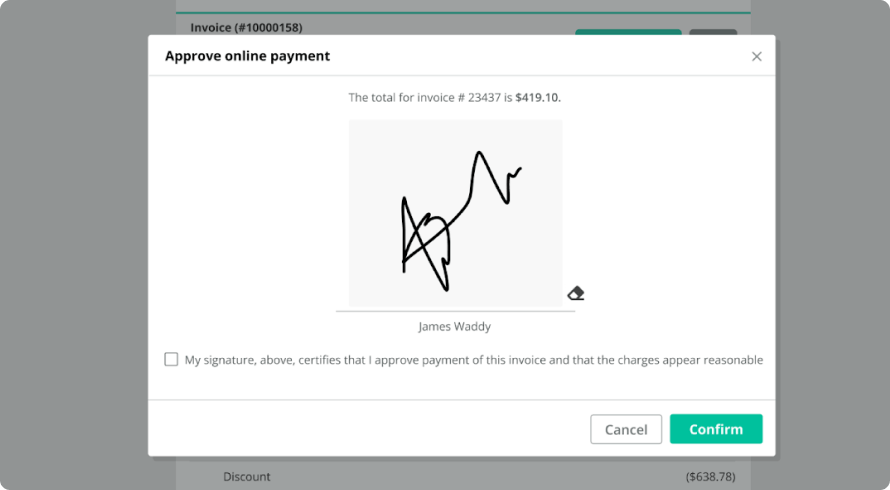

1) Digital signatures

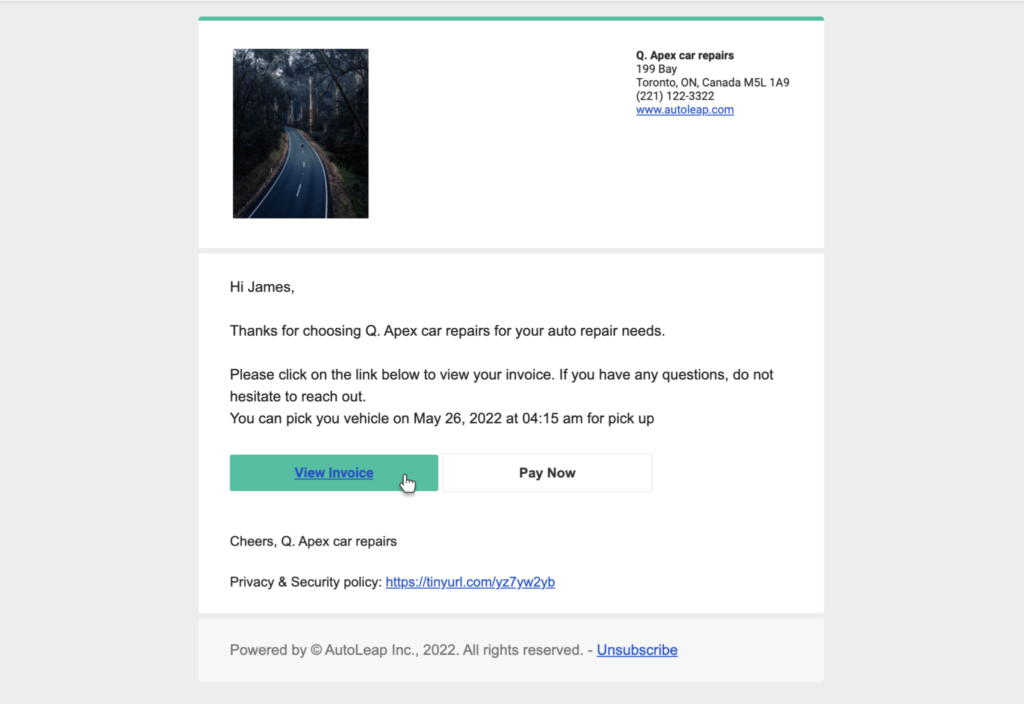

Signatures are a tried and true way to secure a document, which is why they’re so important for any legal documents you have. With Autoleap, your customers can leave a digital signature before making online payments. This extra layer of protection confirms that payments are genuine in case of a false refund claim. It also makes disputes an easier process to handle.

2) Stolen card alerts

If payment is made using a card that was reported stolen, you’ll be notified right on the main AutoLeap dashboard. This flagged alert will let you know which card specifically is stolen, allowing you to flag the relevant attached accounts and take the necessary precautions.

Closing thoughts

Managing payments has become an easier process over time, and there are many different security measures in place to help assist the process. Letting your customers make easy, secure payments will provide an excellent value addition for your shop. This reliable customer service will also improve your shop’s reputation. Even for internal use, having all your transactions in one place will allow for easy reconciliation and tracking—without the margin of human error.