You’re ready to open your auto repair shop. But before you can turn that dream into a reality, a decision must be made—where will your shop call home? Leasing space or buying a space for your auto shop is more than just a financial decision. It’s about setting the foundation for your business’s future. Do you opt for the flexibility of leasing, or do you invest in property ownership to build long-term equity?

Here’s a closer look at the pros and cons to help you make an informed decision.

The pros of leasing a space for an auto repair shop

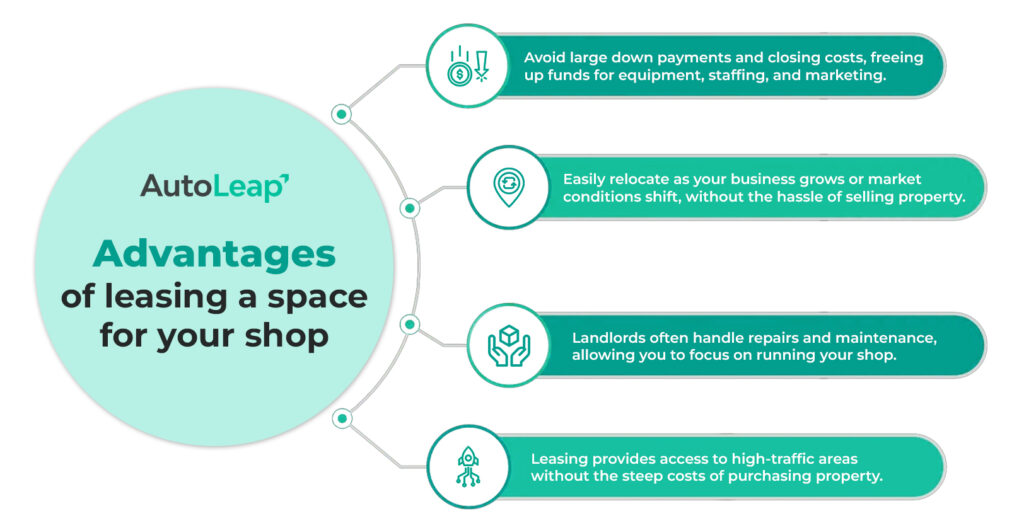

1. Lower initial costs

The most appealing aspect of leasing space for your auto repair shop is the reduced upfront capital investment. If you’re purchasing property for your shop, that will require a huge down payment and closing costs. But with leasing, you can save your money on that initial expense. This financial flexibility means you can allocate more funds to other areas of your business. You can purchase state-of-the-art equipment, hire skilled staff, or invest in marketing to attract more customers.

2. Flexibility

Leasing provides a level of flexibility that buying cannot match. It allows you to relocate if

- Your business grows

- Market conditions change

- Customer demographics shift

You’re not tied down to a single location. In the auto industry, being in the right location can help you attract customers and build a strong reputation. And leasing space gives you the freedom to move to a more lucrative area or upgrade to a larger space without having to sell property.

3. Less responsibility for maintenance and repairs

When you lease a space, the responsibility for property maintenance, repairs, and sometimes even upgrades often falls on the landlord. This reduces the operational burdens for you. You can focus on running your business. And you won’t have to worry about the costs and logistics of maintaining the building, fixing structural issues, or handling unexpected repairs.

4. Potential for prime locations

If you want your auto shop to be in a prime location, then leasing is a great option. Buying property in prime locations with high traffic will be expensive. But, leasing allows access to these areas without the hefty price tag.

The cons of leasing a space for an auto repair shop

1. Lack of property control

Leasing means you don’t have control over the property. You will have to abide by the terms and conditions set by the landlord. This means restrictions on modifications and improvements. But auto shops need the flexibility to make alterations to the space. They need to accommodate equipment, enhance workflow, and create a customer-friendly environment. If your lease agreement doesn’t allow these changes, you won’t be able to fully optimize the space for your business needs.

2. Variable costs

Leasing costs can be unpredictable, especially when you have to renew your lease. The following can increase rent that can negatively affect your long-term budget:

- Market conditions

- Inflation

- Changes in the area’s popularity

Lease payments fluctuate and that can make it challenging to maintain a consistent cash flow and plan for future investments.

3. No equity building

Your monthly lease payments contribute to your landlord’s equity, not your own. This means you are not building an asset that could be appreciated over time. You won’t be able to sell at a profit because you don’t have an ownership stake in the property. This lack of equity can be a disadvantage, especially if property values in your area rise.

4. Operational restrictions

There might also be operational restrictions that can impact your auto shop business. For instance, there might be a limitation on:

- The types of services you can offer

- Your hours of operation

- Signage and advertising you can display

Such limitations will keep you from achieving your auto shop’s full potential. Before signing a lease thoroughly review the terms to make sure they align with your business and future plans.

Making the decision: Lease or buy?

1. Evaluating long-term business goals

Consider where you see your business in the next five to ten years.

- Do you plan to expand to multiple locations?

- Are you aiming for long-term stability in a specific area?

First, think about your business objectives and then align your real estate decision with that. This will help you choose the option that best supports your growth and operational needs.

2. Cost-benefit analysis

Compare the immediate financial impacts of leasing versus buying.

- Include upfront costs, ongoing expenses, and potential for future returns.

- Take into account factors like cash flow, asset building, and operational flexibility.

Consider how each option fits into your overall business strategy. .

3. Seek professional advice

Consult with real estate professionals, financial advisors, and other auto repair shop owners. This will provide valuable insights and experiences to inform your decision. They can help you with lease agreements, property valuations, and market trends. This will help you make a decision that aligns with your financial and business goals. It will give you the knowledge to make a confident and informed choice.

Wrapping up

According to some threads on Reddit, there are mixed opinions on buying an existing business. Some say it is the best decision. They say existing shops perform much better. Since you will get calls from day 1. And you will be able to leverage the existing client database. However, some say buying a business was very costly for them and it led them to sell their house.

At the end of the day, leasing a space for your auto repair shop has its own set of challenges. But it also has plenty of advantages that you can consider. It provides lower initial costs, flexibility, and reduced maintenance responsibilities. But, it also comes with limitations like lack of property control, variable costs, and no equity building.

Before making a decision, evaluate your long-term business goals, financial situation, and the specific needs of your auto repair shop. Consider both pros and cons and get professional advice. This will help you choose the option that best supports the growth and success of your business.