As a shop owner, you follow your usual procedures. From employee handbooks to clock in and clock out guidelines, you try to account for every possible detail.

But what about your cash flow procedure? When it comes to where your business’s money goes, you will need a smart strategy in place.

Chris’s insights will help you take the emotion out of controlling your shop’s cash flow!

But before focusing on the topic of cash flow management, it’s important to establish some target margins for your shop.

Target margins for your auto repair shop

Do you know what your shop’s current margins are?

From gross profit to labor, parts and beyond, Cotton recommends the following targets:

If your numbers fall far below these benchmarks, don’t panic! Cotton will cover how you can improve your margins in more detail.

Now, to the topic of your shop’s income statements. Why do guardrails even matter?

Why you need guardrails for your shop’s income statement

It’s tax season. You receive your shop’s tax bill from the government.

“That number can’t be right!” You owe thousands of dollars and never saw it coming. How did you not prepare for this? Do you even have enough money saved away to cover this expense?

If this nightmare scenario sounds familiar, it’s time for a change. To avoid ever putting yourself in this situation again, Cotton recommends establishing guardrails to track and measure where your shop’s money goes.

“Make sure you actually have the cash that your income statement says,” says Cotton. Put the shop’s income in the right place to work for you, and you will always have cash available whenever unexpected bills pop up.

Staying on this saving theme brings us to our next cash flow lesson: your shop’s sales tax doesn’t belong to you.

Remember: your shop’s sales tax doesn’t belong to you

It’s easy to forget that the extra sales tax listed on a customer receipt doesn’t belong to your shop.

But it’s important to remain mindful of the role this money plays. As Cotton describes, it is simply a “pass through.”

“When I say sales tax, I mean sales tax for the business. This is a tax account that we’re going to set aside to pay your tax liability for the end of the year,” says Cotton.

So what does Cotton recommend doing with that money?

Since the sales tax technically isn’t yours, you need to set it away for a later date. That money should go directly to a separate bank account, out of sight and out of mind.

Cotton establishes 5% as the cash flow allocations you should set aside to pay the government come tax season.

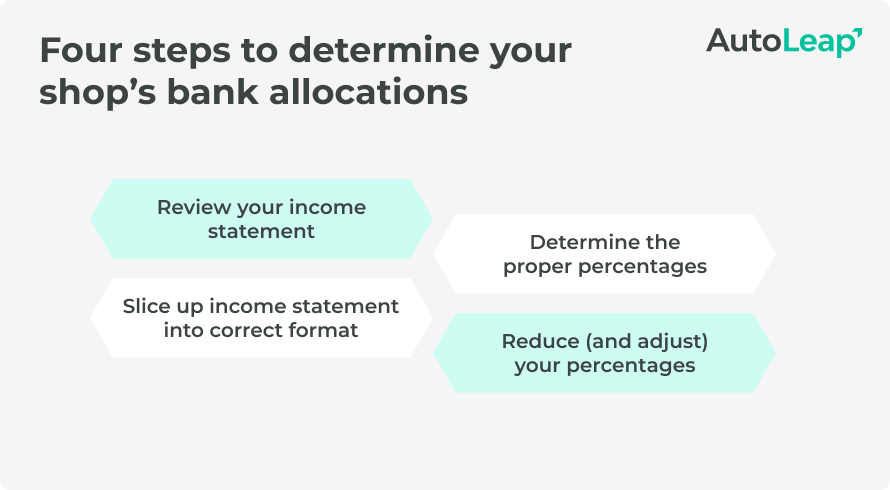

Here are four easy steps to manage that process:

- Put 5% of all sales into a separate bank account

- Ask your accountant how much you owe in taxes at year-end

- Take this money out of the account and pay your government tax bill

- Pocket whatever is left in the account as pure profit

Don’t let taxes ruin your Valentine’s Day, like Cotton’s experience after receiving a surprise $16,000 shop bill!

Beyond sales tax allocations, Cotton shared other allocation benchmarks to strive for. Those include:

- Operating expenses = 20%

- Parts = 20%

- Payroll = 30%

- Profit = 25%

“With this model, we are putting 25 cents of every dollar that comes into the business into a bank account for profit,” says Cotton.

Do your margins currently fall far below these benchmarks? If so, your income statement needs some reorganization.

To start that process, you will have to break out different categories on your income statement.

Breaking out your income statement categories

Revisiting your income statement doesn’t have to feel overwhelming.

Cotton recommends keeping the process simple. Get out four to six different colored highlighters and go through line by line.

Break out the income section of your statement into five different categories, including:

- Parts

- Labor

- Tires

- Sublet

- Shop supplies

Your statement should feature vertical columns for income, cost of goods sold (COGS), expenses and payroll. Overall, keep things brief. Your statement doesn’t have to sprawl page after page.

“My ideal income statement is two pages or less. If you have an income statement that is five pages long, you have way too many categories in there,” says Cotton.

You have reviewed the statement, broken out new categories, and sliced up the format. Now, the hard part: evaluating the current percentages to allocate for each category.

Finding (and adjusting) your allocation percentages

Using this format, you take a look at the current percentages your shop allocates. The numbers reveal a staggering truth: your current allocations won’t give you enough money to make payroll or settle an upcoming bill!

These examples of being “short” are common but avoidable. In this scenario, Cotton recommends adjusting your allocation percentages. If that doesn’t work, your shop likely requires changes on a larger scale.

But remember, you only have 100% to work with for allocations. “If you need 2% more in payroll, that has to come from somewhere else or you have to increase sales. I always say to run your business by the numbers, not emotion,” says Cotton.

You could come up short in this allocation exercise for many reasons. For two categories, parts and labor, Cotton provided examples of potential root causes.

Potential reasons for labor shorts include:

- Wrong pay plan

- Lack of productivity

- Not billing out time correctly

- Techs gave more time than you collect

Potential reasons for parts shorts include:

- Not following parts matrix

- Not getting credit for cores/returned parts

- Not holding SAs accountable for their job and setting clear expectations

Now to the positive. Let’s take a look at a more preferable experience reviewing allocations. You crunch the numbers and things look good! Your shop has plenty of profit left over.

Cotton describes this situation as a “windfall”. With a windfall, you now have extra money to get creative with.

As a shop owner, you may choose to pay debts with this extra funding. You can also pocket it as pure profit, or give your employees raises to keep everyone at the shop happy. The possibilities are endless and exciting!

Setting up your shop’s bank accounts for allocations

You reorganized your income statement and adjusted your shop’s financial allocations. With a new plan in place, it’s time to set up your bank accounts.

In terms of options, Cotton shared several recommendations. You can always negotiate with big banks for favorable account terms, but local credit unions and online banking with immediate transfers also warrant consideration.

For term specifics, ensure the bank account doesn’t charge fees for a $0 balance. You want to avoid overdraft fees altogether. “Making allocations is not hard. Again, it’s the bank,” says Cotton.

Cotton recommends using multiple accounts across two banks to organize your shop allocations.

Here is a specific example of a potential format you can follow:

Bank Set Up: Example for Shop Accounts

Bank 1

Account 1: Tax – 3%

Account 2: Debt – 2%

Account 3: Profit – 2%

Account 4: OPEX – 35%

Account 5: Parts – 23%

Account 6: Payroll – 35%

Bank 2

Account 7: Sales Tax

Account 8: Tax Hold

Account 9: Profit Hold

With this format, you can make allocations across all accounts in 30 minutes or less. When that distribution becomes a habit, Cotton says your auto repair shop will greatly benefit.

But how do you even make it a habit? Cotton shares plenty of useful tips for getting started with allocations once your accounts activate.

How to start making shop allocations

Cotton says building a routine for your allocations is all about rhythm.

“Usually if someone is really on the ball and they get the bank accounts done, we can do this whole process and have it started in less than a month. If someone takes five or six months, it’s because they’re dragging on the bank accounts,” says Cotton.

Add your sales tax to Account 7 at the end of every week, and focus on your other allocations after that. Long term, you should form a four, eight, and 12-month cash flow allocation plan for your auto repair shop.

But this process shouldn’t feel rigid! You can always adjust every quarter, and flexibility is important. “Your business is unique. Let’s make this unique to you. We can format this to your shop and go,” says Cotton.

You can base your adjustments on observations, like the amount of windfall this system generates. Or maybe you want to dedicate a percentage of profit to another category. “We don’t want to crank the dials all the time. We want to set it, let it sit, and rock along,” says Cotton.

Now, to an even more thrilling topic: bills. Do you have a smart system in place?

Developing a system to pay your shop’s bills

Cotton suggests choosing two days that make the most sense to pay your shop’s bills. After you determine the days, stick to your plan. “Have a process when you pay your shop’s bills,” says Cotton.

Make your vendors aware of these payment dates you prefer, but make the dates non-negotiable.

One fun trick in this area is to maintain a zeroed-out expense account for bills. You will first want to double-check that this account doesn’t charge overdraft fees.

From there, set up autopay for the various vendors you use. When an autopay inevitably doesn’t go through due to the empty account, you can reassess whether the vendor’s service will even suit your shop moving forward.

“Make those vendors call you and then make the determination whether you keep those vendors or not,” says Cotton.

You make that final determination, and have a solid system in place to pay bills and regularly evaluate the value each vendor delivers.

You now have a plan for income statements, bank account allocations and even monthly bills. But what about when it’s finally time to get paid or pay your taxes?

That brings us to Cotton’s final webinar topic: quarterly movement of money for your shop’s profit holds and tax holds.

Quarterly movement of your shop’s money

You previously set up separate bank accounts for profit holds and tax holds. Now, it’s time to cover why.

For tax holds, the logic is simple. You set this money aside to have plenty of savings for your government tax bill later in the year. Every quarter, take your tax money and move it to this “hold account”.

The same premise applies to profit holds. Cotton recommends taking half of the profit from the quarter to pay yourself and your team. With the other half, place that into the separate “hold” account for later.

» Looking to transform your shop? Discover how AutoLeap can help.

Closing thoughts

When it comes to managing your auto repair shop, profit and cash flow allocation is never the most thrilling topic. But with a system like the one Chris Cotton outlines, you can position your shop well for organized finances, impressive savings and accelerated revenue growth.