When was the last time you took a good, hard look at the numbers shaping the Canadian auto industry? Whether it’s sales trends, EV adoption rates, or repair industry growth – stats can tell us more about where we’re headed than any guesswork ever could.

This blog is your go-to guide for breaking down the latest trends. Let’s explore how the Canadian auto industry is evolving, one stat at a time!

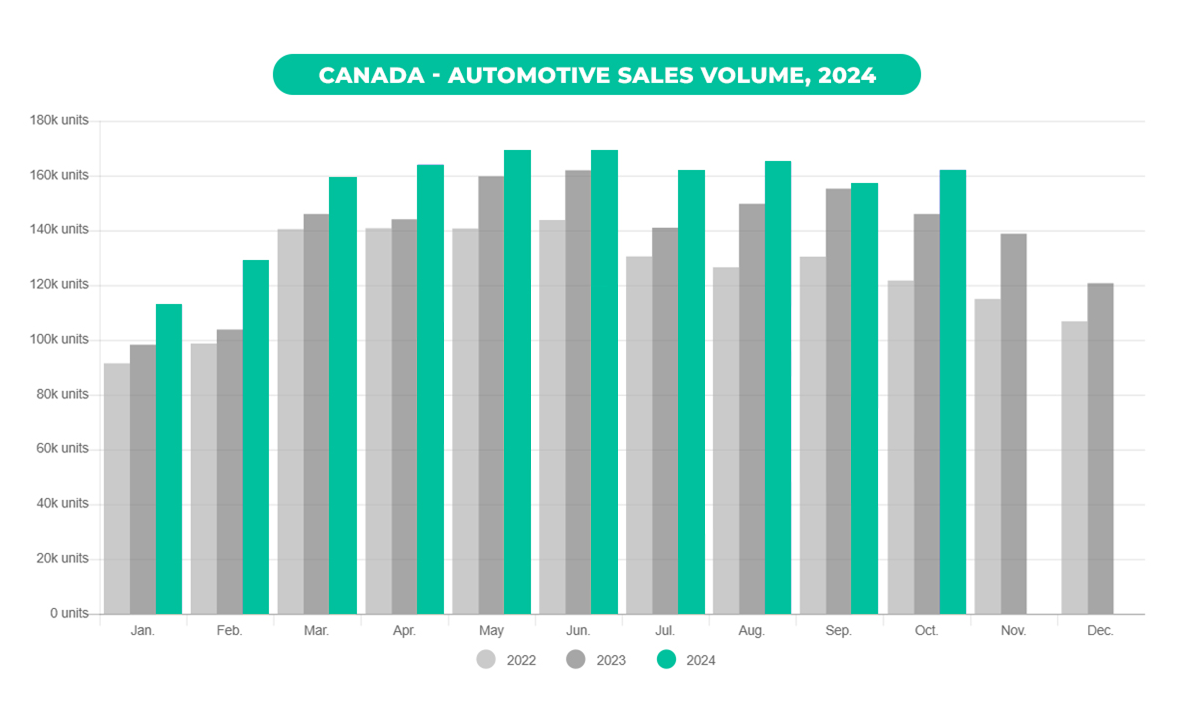

Canadian auto sales in 2024

Canadian auto sales surge 8.8% in October.

October 2024 was a strong month for the Canadian auto market, with an estimated 162,000 vehicles sold, an 8.8% increase compared to October 2023. A key reason for this growth? Two extra selling days in October 2024 gave dealerships more opportunities to close sales.

But there’s more to the story than just the calendar. The Seasonally Adjusted Annual Rate (SAAR) for September 2024 stood at a healthy 1.98 million units, making it the third-highest total this year. While it didn’t quite match the sales surge of January and February (driven by pent-up demand), it reflects sustained momentum as the year progresses.

What’s driving these numbers?

- Improved inventory levels: After years of shortages, dealerships now have a better supply of vehicles, meeting the demand of customers who had been waiting.

- Consumer confidence: With economic stability improving, more Canadians feel confident making big purchases like a car.

- Shift in preferences: Light trucks, SUVs, and crossovers continue to dominate sales, reflecting Canadians’ preference for versatility and comfort.

Looking ahead: A strong finish for 2024

With just two months left in the year, the market is on track to hit an annual total of 1.8 million vehicles sold—a milestone last achieved in 2019. Scotiabank recently estimated 1.78 million sales for 2024 and predicts an even stronger 1.80 million sales in 2025.

This steady growth highlights the industry’s resilience. With better supply chains, strong consumer demand, and a growing interest in electric and hybrid vehicles, Canada’s auto industry is heading toward a bright future.

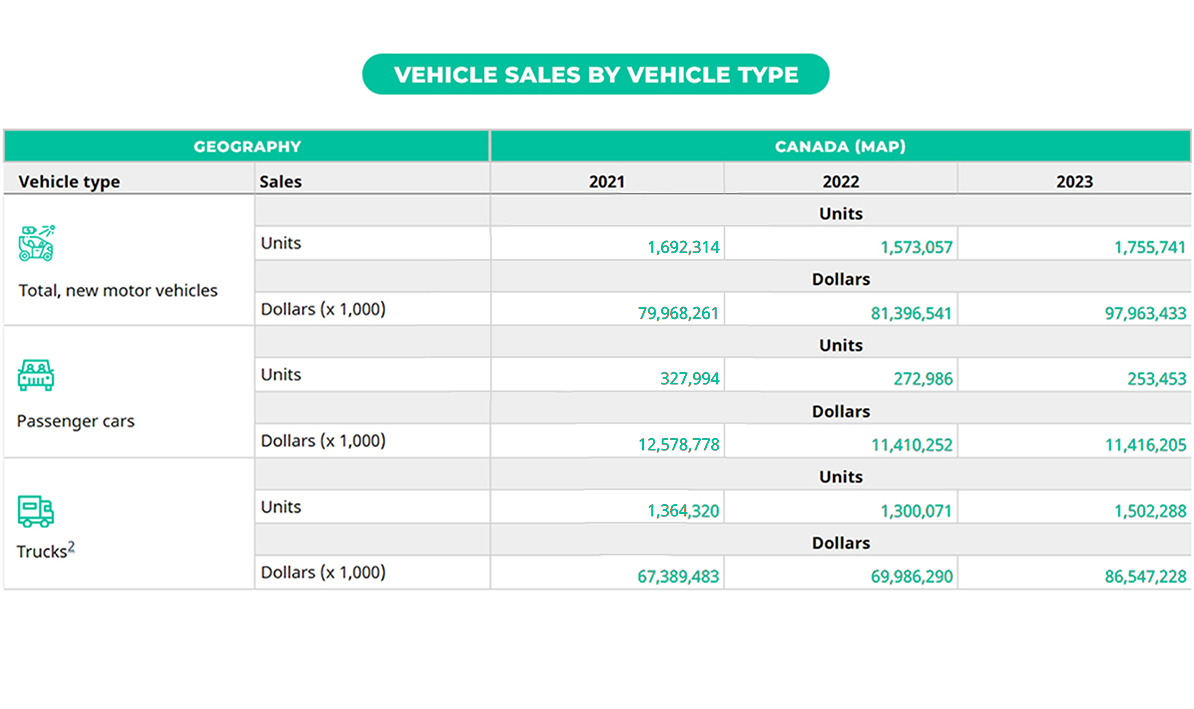

Vehicle sales by vehicle type

Vehicle sales in Canada: Trucks take the lead!

Let’s dive straight into how different types of vehicles—passenger cars and trucks—fared over the past three years. The numbers reveal some interesting trends!

Passenger cars: A steady decline

- 2021: Canadians bought 328,000 cars.

- 2022: Sales dipped to 273,000 cars.

- 2023: The downward trend continued, with just 253,000 cars sold.

Why are passenger car sales shrinking?

- The SUV and truck boom: Canadians are leaning toward larger vehicles for their space, comfort, and versatility—whether it’s for family trips or hauling gear.

- All-weather reliability: Cars often take a backseat to trucks and SUVs in a country with tough winters and varying terrain.

- Lifestyle shift: The preference for larger, multi-functional vehicles aligns with outdoor-focused lifestyles and a need for vehicles that do more than just get you from A to B.

Trucks: The clear favorites

- 2021: Truck sales were at 1.36 million units.

- 2022: Despite a slight dip to 1.30 million, trucks maintained a stronghold.

- 2023: Sales surged to 1.50 million trucks!

Why are trucks so popular?

- Versatility and durability: Trucks are perfect for work, play, and everything in between. Their ability to tow, haul, and handle rough roads makes them an easy pick for many Canadians.

- Fuel efficiency upgrades: Modern trucks now offer better fuel efficiency, making them more economical to own.

- Cultural preference: Canadians have a deep-rooted love for trucks and SUVs, reflected in buying patterns that consistently favor these vehicles.

- Rising hybrid and electric options: More environmentally friendly trucks are entering the market, appealing to eco-conscious buyers who still want the power and functionality of a truck.

What does this mean for the auto industry?

The shift toward trucks and away from passenger cars highlights a clear preference among Canadians for vehicles that provide more utility, space, and adaptability. Auto manufacturers are responding by doubling down on trucks and SUVs, with newer models offering advanced tech, better efficiency, and sleek designs to cater to this growing demand.

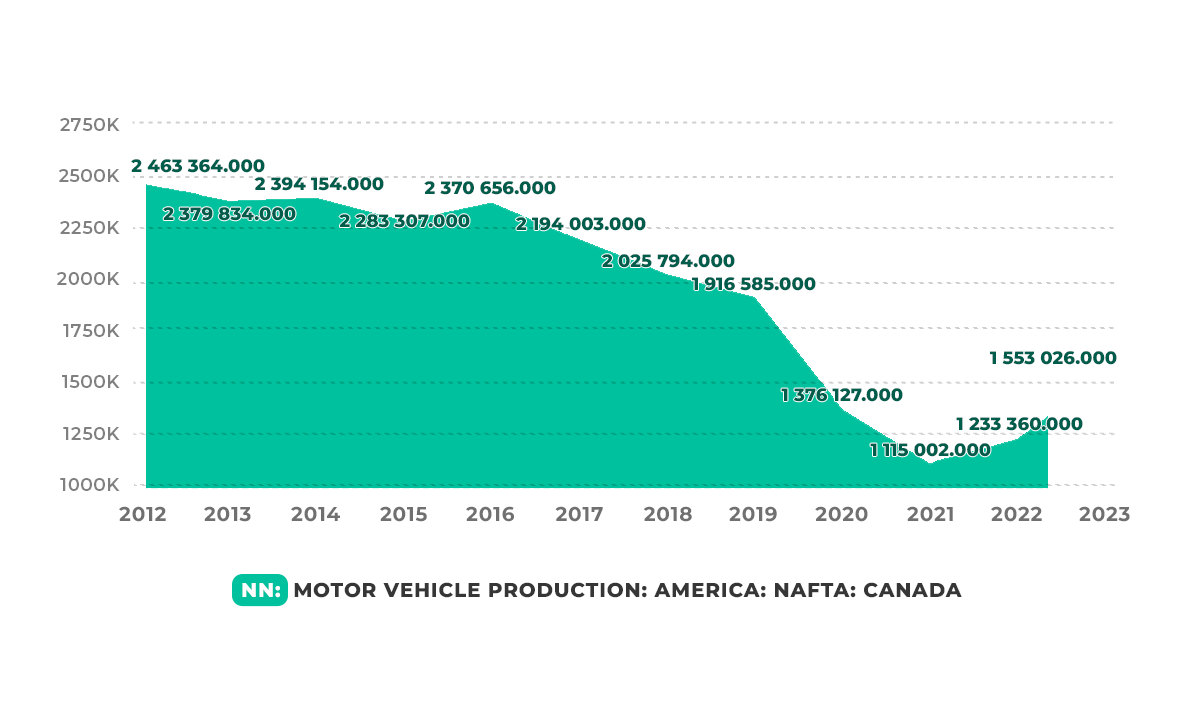

Canada vehicle production

Canada’s vehicle production revved Up in 2023!

Big news for Canada’s auto industry—vehicle production hit 1,553,026 units in December 2023! That’s a solid jump from 1,233,360 units in December 2022.

Canada’s motor vehicle production has been tracked yearly since 1997. Over the years, it has averaged about 2.28 million units, with some incredible highs and challenging lows:

- All-time high: Over 3 million units in 1999 (what a year!).

- Lowest point: Just 1.1 million units in 2021, during the pandemic supply chain crisis.

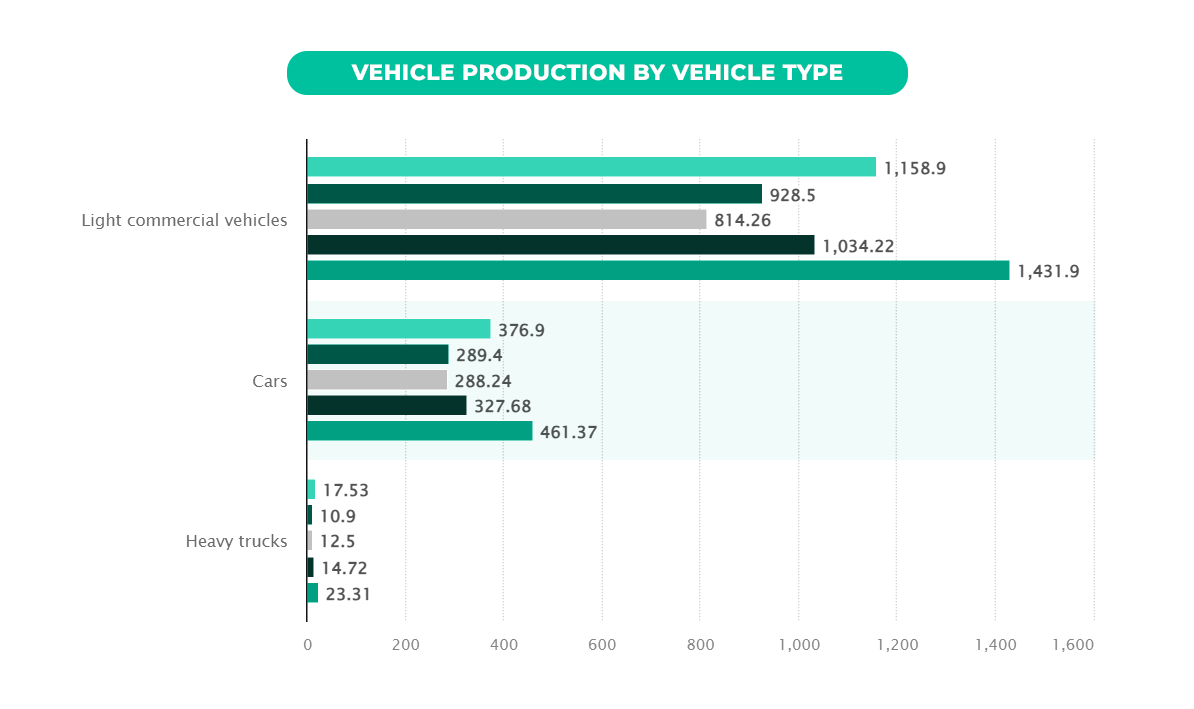

Vehicle production by vehicle type

Canada’s auto industry hits the gas in 2023 with a 26% boost!

Did you know? Canada rolled out 1.16 million light commercial vehicles, nearly 377,000 passenger cars, and 17,530 heavy trucks in 2023. That’s a huge leap—an impressive 26% increase compared to the previous year!

Leading manufacturer's hubs in Canada

Did you know Ontario leads all of North America in vehicle production? That’s right! This province is home to assembly plants from six of the world’s top automakers.

From Windsor to Brampton, Oakville to Oshawa, and Alliston to Cambridge, Woodstock, and Ingersoll—Ontario’s plants are buzzing with activity, building cars and trucks that hit roads around the world. It’s no wonder Ontario is called the heart of Canada’s auto industry!

1. Ford Motor Company

Plant Name | Products |

Oakville Assembly | Ford Super Duty (Future) |

2. General Motors

Plant Name | Products |

CAMI Assembly | BrightDrop Zevo |

Oshawa Car Assembly | Chevrolet Silverado |

3. Honda

Plant Name | Products |

Honda of Canada Manufacturing | Honda Civic, Honda CR-V |

4. Stellantis

Plant Name | Products |

Brampton Assembly | Jeep Compass (Future) |

Windsor Assembly | Chrysler Pacifica, Chrysler Voygager/Grand Caravan, Dodge Charger |

5. Toyota

Plant Name | Products |

Toyota Motor Manufacturing Canada Cambridge Facility | Toyota RAV4, Lexus NX, Lexus RX |

Toyota Motor Manufacturing Canada Woodstock Facility | Toyota RAV4 |

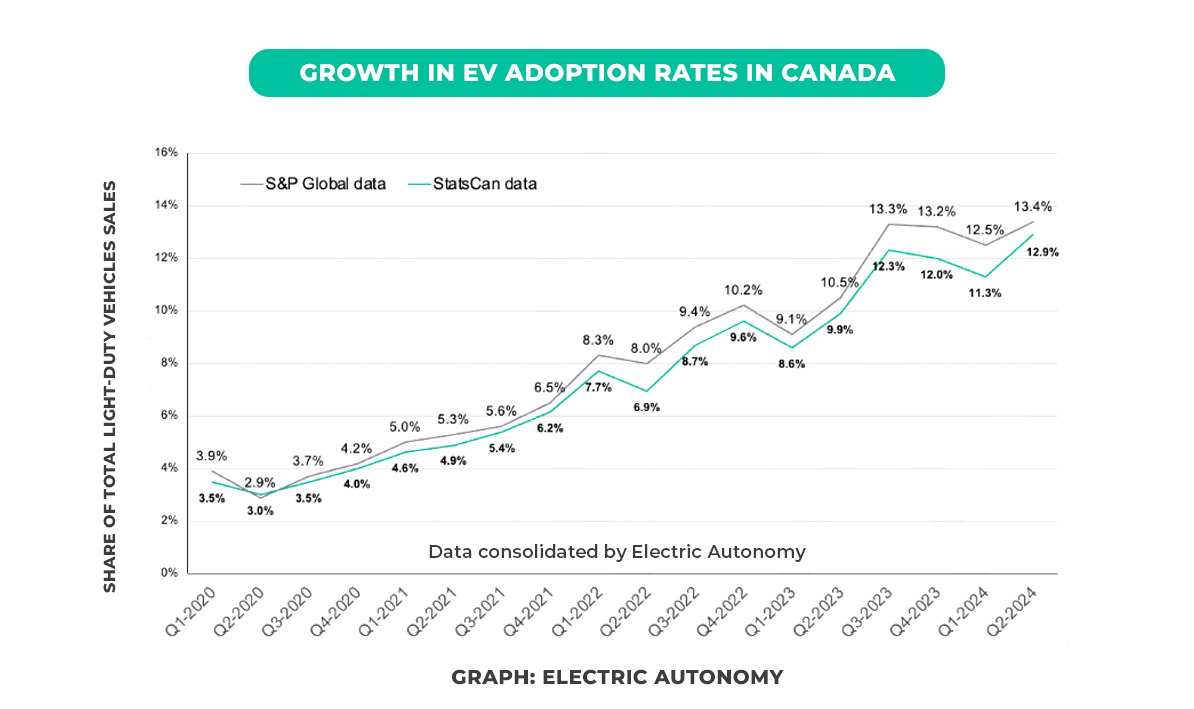

Growth in EV adoption rates in Canada

Zero-emission vehicle (ZEV) sales in Canada are on the rise, and the latest numbers show some exciting growth:

- After a slower start to the year, Q2 2024 saw ZEVs hit a record 13.4% market share, up from 12.5% in Q1.

- S&P Global Mobility and Statistics Canada both report strong numbers, with the latter showing ZEV registrations at 12.9% for Q2 2024.

- In comparison to the U.S., Canada is leading the charge, with the U.S. at just 10% ZEV penetration.

- S&P predicts that Canada’s ZEV adoption will hit 16% by the end of 2024.

Looking at specific types of ZEVs:

- Battery-electric vehicles (BEVs) are seeing an adoption rate of 9.9% in Q2 2024, up from 9.2% in Q1.

- Plug-in hybrid electric vehicles (PHEVs) also showed growth, with a 3.5% adoption rate in Q2, slightly up from 3.3% in Q1.

These numbers are a strong indicator that zero-emission vehicles are gaining traction in Canada, and it’s only expected to grow from here!

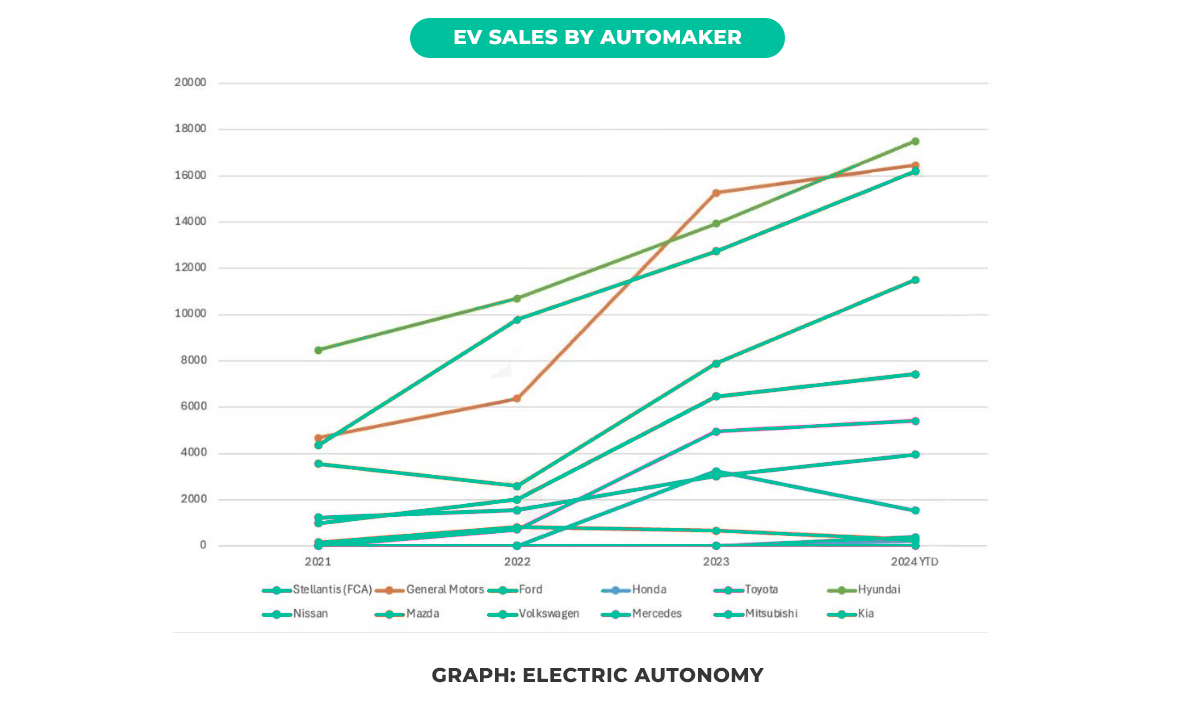

EV sales by automaker

This chart shows the EV sales by OEM (Original Equipment Manufacturers) from 2021 to 2024, and it gives us an interesting look at how electric vehicle sales have been growing across various car brands. Here’s the breakdown:

- Stellantis (FCA) and General Motors are leading the pack in terms of sales growth, with Stellantis (in orange) having a noticeable spike in sales, especially in 2023 and 2024.

- Ford and Volkswagen follow closely behind, showing strong growth in recent years.

- Hyundai (in green) and Kia (in blue) are also climbing steadily, with their numbers looking pretty solid across the years.

- On the other hand, brands like Mazda, Toyota, and Honda seem to be a bit slower to jump on the EV bandwagon, with relatively flat growth over the years, though Toyota still shows up as a steady player.

- Mitsubishi and Mercedes have shown some growth, but they’re far behind the big hitters like Stellantis and GM.

Canada’s automotive key export partners

In 2022, Canada exported $29.4 billion worth of cars, making it the 9th largest car exporter in the world. Cars were Canada’s 2nd most exported product that year.

Here’s where Canadian cars were headed:

- United States: The biggest buyer, importing $27 billion worth of cars.

- China: Coming in second with $519 million in car imports from Canada.

- Mexico: With $306 million in car exports.

- United Arab Emirates: Bought $162 million worth of Canadian cars.

- Chinese Taipei: Imported $151 million in cars from Canada.

The fastest-growing markets between 2021 and 2022 were:

- United States: Increased by $633 million.

- Mexico: Grew by $87.1 million.

- United Arab Emirates: Saw an increase of $35.5 million.

Canada’s car exports are on the rise, with strong growth in these key markets!

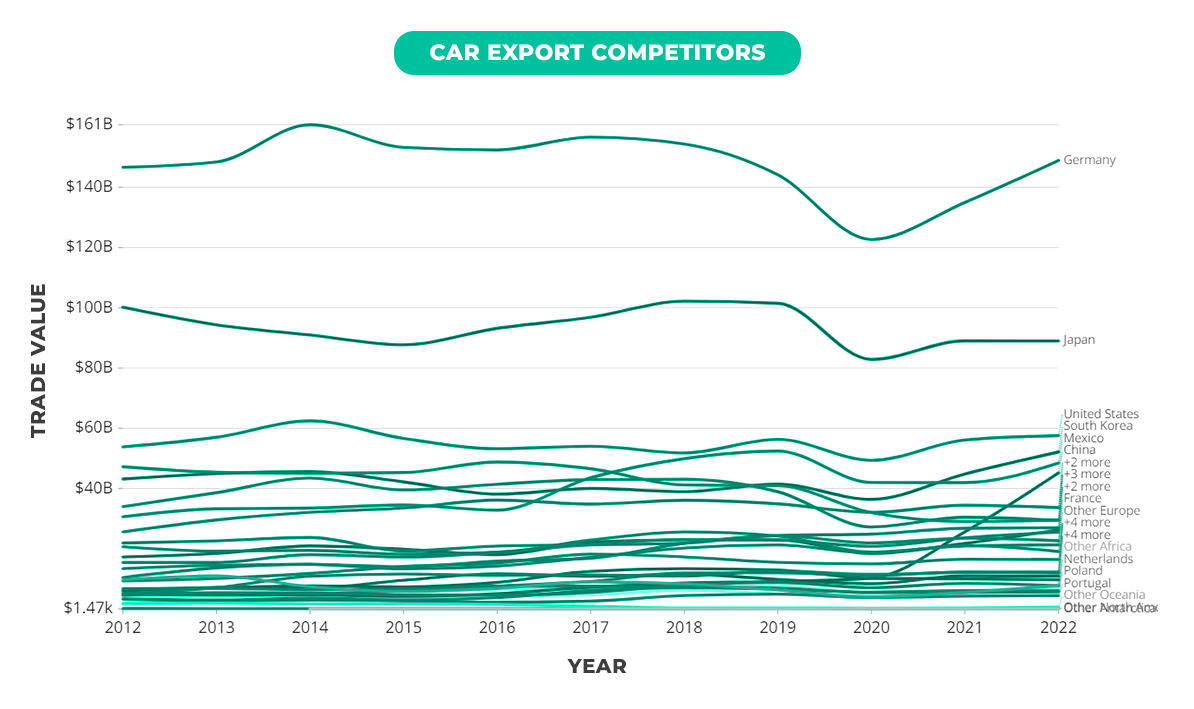

Here’s a breakdown of Canada’s main competitors in the car trade, for exports.

- Germany: Dominating the export market with a huge $149 billion in car exports. No surprise here, given Germany’s strong automotive industry.

- Japan: Still holding its ground, exporting $89 billion worth of cars, maintaining its competitive position in the global market.

- United States: With $57.5 billion in car exports, the U.S. is another major player, making significant strides in the global car export market.

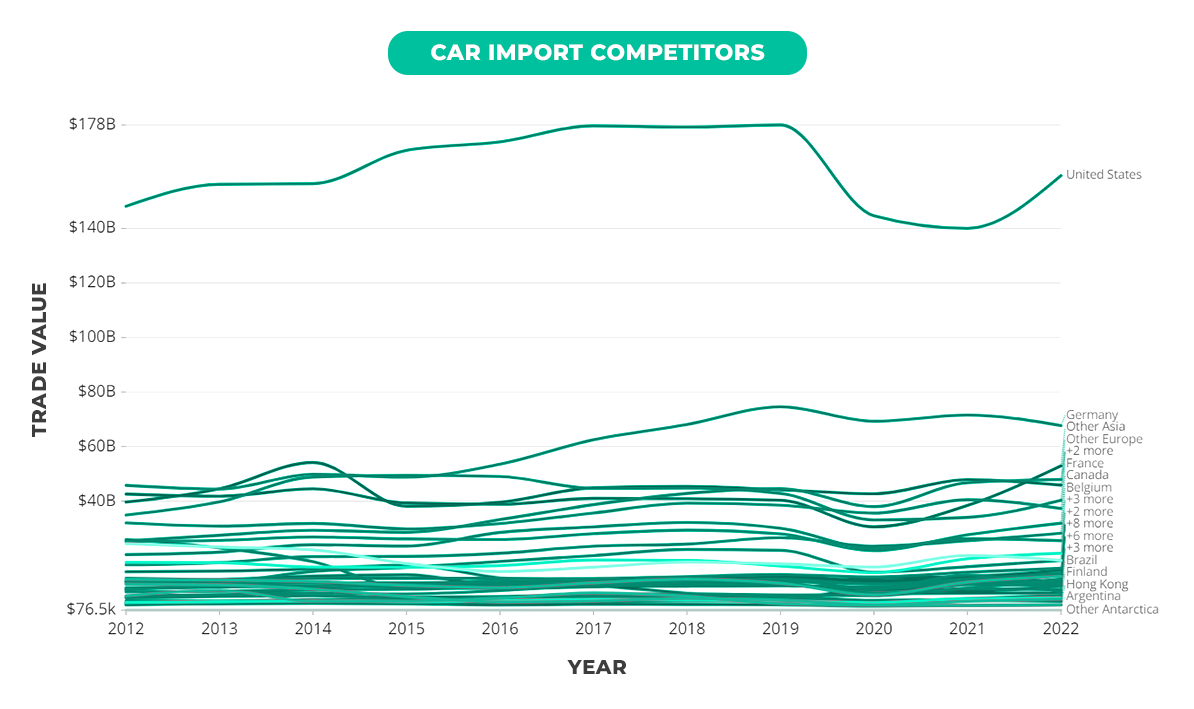

- United States: Leading the charge for car imports with a whopping $159 billion. The U.S. is a huge consumer of cars, importing from all over the globe.

- Germany: As a strong car exporter, Germany also imports $67.7 billion in cars, showing its significant role in the global car trade.

- China: Making waves in car imports, China comes in with $45.8 billion, reflecting its growing demand for international vehicles.

Future predictions for the auto industry in Canada

Looking ahead, Canada’s vehicle market is on track for impressive growth. Vehicle registrations are expected to reach around 51 million units by 2028, a significant jump from 30.5 million in 2023. That’s a solid 8% annual growth rate, reflecting the country’s strong presence in the automotive industry. Since 2010, Canada’s vehicle registrations have skyrocketed by 71.7%, securing its spot as a major player in the global market.

In 2023, Canada ranked second in vehicle registrations worldwide, tied with Australia at about 30.5 million units. China and Austria rounded out the top four.

As for production, Canada’s vehicle output is set to grow modestly, reaching about 2.05 million units by 2028, up from 1.97 million in 2023—an average growth of 0.6% per year. While vehicle production has seen a slight dip of 0.5% annually since 2002, Canada still holds a strong position. In 2023, it was the 12th largest vehicle producer globally, with Indonesia ranking just ahead, also producing 1.97 million units. Meanwhile, the United States, Japan, and Germany hold the top spots in global vehicle production.

With these predictions, it’s clear that Canada will continue to be a key player in the automotive world, both in registrations and production!