When your business is on the road, your vehicle and equipment are essential to your day-to-day work. Safeguarding them becomes more important.

Insuring your business is a crucial step to protect yourself from financial liabilities and save money. You could be liable for anything from a car accident to property damage. A good mobile mechanic insurance plan can protect your shop from the financial risks that come with lawsuits and claims.

Mobile mechanic insurance might require thorough research, considering it is a niche in itself. Here is what you need to know so that you can be on the road stress-free.

Unlock powerful tools to manage your shop. Get the full AutoLeap experience today.

What is mobile mechanic insurance?

You must always have mobile mechanic insurance, whether full or part-time, and work from a garage or on the road. Mobile mechanic insurance is specifically designed for mechanics who do not operate from a brick-and-mortar location. Your business is the kind that provides a service to clients at their homes and workplaces.

So if you’re about to start offering mobile mechanic services, it’s important to consider acquiring insurance in the early stages.

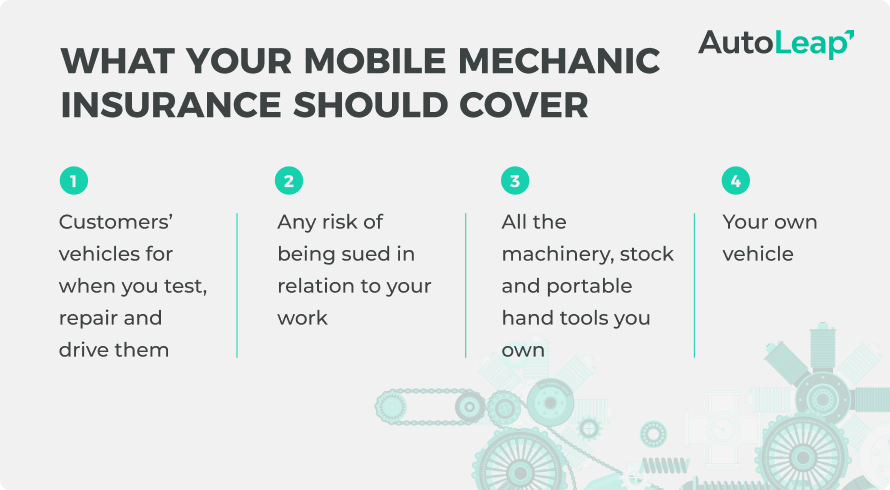

This insurance for mobile mechanics covers the vehicles you drive, as well as those of your clients, employer’s liability, and equipment coverage for fixed and mobile machinery.

The policy should have minimum insurance requirements and it will cover machinery, tools, but more crucially must cover your customer’s car while you test and diagnose them.

For a streamlined workflow and better business management, consider investing in mobile mechanic software to complement your insurance and service delivery efforts.

Here is a list of what your mechanic insurance should cover:

If you are new to the game, involve a broker before making final purchases. Terminology, paperwork, and everything in between can prove confusing and lead to sign-up mistakes.

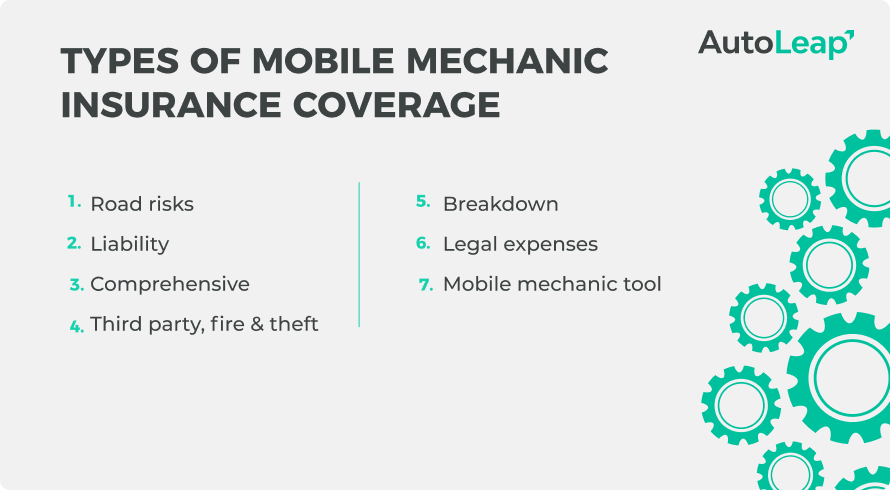

Types of auto mechanic insurance

1. Road risks insurance

Gallagher defines road risk insurance as coverage “specifically designed for motor traders who drive vehicles they don’t own, including cars bought for the business.”

As a self-employed mobile mechanic, this insurance is an absolute must. Accidents are inevitable, no matter how good a driver you are. You need this insurance for yourself and for your clients as well.

For instance, if you accidentally scratch a customer’s vehicle while testing it, road risk insurance can help cover the repair costs, saving you from hefty expenses. While your customer’s car is in your care, a road risk policy ensures you meet the minimum insurance needs while the vehicle is with you.

Here is what a road risk policy covers:

- Named driver

- The policyholder’s (or named driver’s) vehicles

- The customers vehicles while it is in your care (motor trade use only)

2. Liability insurance

Liability insurance is another consideration for any mobile mechanic. If accidents were to happen (and they most likely will in this business), you wouldn’t be held responsible. Liability insurance will help ensure that mobile mechanics have the means to defend or settle a claim made against them.

Hartford defines liability insurance as coverage that “helps protect you financially if you’re found legally responsible for property damage or personal or bodily injury to a third party.”

For example, if a customer slips and falls while you’re working on their car, liability insurance can cover their medical expenses and any legal fees associated with the incident.

Here is what liability the mobile mechanic insurance costs and for mobile mechanics insurance can cover:

- Defense costs are associated with claims made against the mobile mechanics.

- Employer’s liability (this is compulsory in the majority of cases if you have employees).

- Hand tools (highly recommended for mobile mechanics).

Types of liability coverage include:

- Public liability insurance – This covers expenses that may arise from a car under your responsibility that may not even have been your fault.

- General liability insurance – This will provide coverage for more generic claims against you.

3. Comprehensive coverage

Progressive defines comprehensive insurance as “an optional coverage that protects against damage to your vehicle caused by non-collision events that are outside of your control.”

It safeguards your vehicle and the cars you work on from various risks, such as theft, fire, vandalism, or natural disasters.

Imagine if your work van gets stolen with all your tools inside. Comprehensive coverage would ensure you’re compensated for the loss, allowing you to replace your equipment and get back on track. This coverage helps you work stress-free, without having to constantly plan for the unknown.

The great thing about this coverage is it covers your vehicle as well.

4. Third-party, fire, and theft coverage

Forbes defines third-party fire and theft insurance as coverage for “accidental damages you may cause to other people’s property or vehicles while on the road, as well as agreed upon cover for your own car.”

This employer’s liability covers you in case you have an accident and the third party is liable. Simultaneously, it also covers for fire, damage and theft. For instance, if a fire breaks out in your workshop and damages a customer’s car, this coverage can help cover the repair or replacement costs.

These things can happen with a customer’s vehicles, which is why you need this protection as a full mobile mechanic insurance. This way, you will be covered without having to break the bank.

5. Breakdown coverage

Nationwide defines equipment breakdown insurance as coverage for “damages caused by covered internal forces, such as power surges, electrical shorts, mechanical breakdowns, motor burnout or operator error.”

Getting breakdown coverage is important so that your work can continue. This is guaranteed assistance in the event that your customer’s vehicle ever stops working. After all, your entire business depends on its dependable performance.

6. Legal expenses coverage

Investopedia defines legal expense insurance as “a form of legal protection insurance coverage… designed to protect against costs stemming from lawsuits brought by third parties as business insurance, but may also cover costs and legal fees associated with lawsuits and employee claims that the insured pursues against others.”

If you were to have any liability claims made against you, you need to be able to cover the legal expenses. This type of insurance will cover any lawful costs in cases. For instance, if a customer sues you for faulty work, legal expenses coverage can provide financial protection and support throughout the legal process.

This kind of suitable cover is crucial when you are in court defending yourself.

7. Mobile mechanic tool insurance coverage

Your tools are the lifeline of your business, and protecting them is crucial.

Mobile mechanic tool insurance coverage ensures that your valuable equipment is covered in case of theft, damage, or loss. Whether it’s your diagnostic equipment, wrenches, or socket sets, this coverage can help you replace essential tools without dipping into your pocket.

How much does mobile mechanic insurance cost?

Costs can vary depending on how big your business is, your personal and business circumstances, and the unique needs of your business. For this reason, an average cost is hard to determine.

However, here are some of the factors that determine cost:

1) Age

If you are under the age of 25, you might have to pay more than an older, more experienced driver. The younger you are, the more the liability. Insurance providers consider younger drivers less experienced and therefore more likely to be involved in accidents.

2) Claims history

If you have a history of making claims for accidents or damages, insurance companies may view you as a higher risk and charge higher premiums to offset potential future claims.

3) The type of coverage

Depending on the kind of plan you choose and how much your medical costs and expenses it covers, it could become more expensive. Comprehensive coverage, which offers broader protection, typically comes with higher premiums compared to basic coverage options.

4) Your vehicle and equipment

Depending on the value of your vehicle and how reliable it is, your coverage cost could change.

For example, having a secure garage to park your vehicle with all the tools would work in your favor over working from an open parking lot.

Wrapping up

Insurance may not cover everything in your business. But it can protect you from the most likely issues that would potentially leave you liable.

Consider these different types of insurance coverage and protect your mobile business as it grows.

FAQS:

What insurance do I need as a mechanic?

As a mechanic, you may consider general liability insurance. General liability coverage is essential for protecting your auto repair business against various risks, including property damage and bodily injury.

What does GL insurance cover?

General liability insurance will help protect your auto repair business from any setbacks caused by bodily injury or damage to your property or a customer’s property.

What is a mobile mechanic?

A mobile mechanic is someone who offers general or auto repair shop service at a customer’s home or workplace. This means they do not work from one physical location.