If you are wondering why automotive business insurance is important then you are at the right place. As an independent auto repair business, you may have dealt with an insurance company—either your own or a customer’s after they got into an unexpected accident.

But what’s the importance of automotive shop insurance? Let’s find out whether you should invest in insurance.

Why is business insurance for an auto repair shop necessary?

There are several reasons to get auto repair shop insurance. It protects your finances against common risks such as theft, lawsuits, and other damage that may occur due to work-related accidents. This is why it’s recommended to acquire the right insurance in the early stages, so your auto shop runs smoothly and is prepared for any unwarranted expenses.

Vehicle repair itself can be tricky, and cars can be unpredictable depending on customers’ driving habits, model of vehicle, modern technology such as ADAS, and other factors that can cause them to break unexpectedly. Investing in quality insurance frees you from worrying about large unexpected costs from break-ins, damage due to natural disasters, accidents, and others.

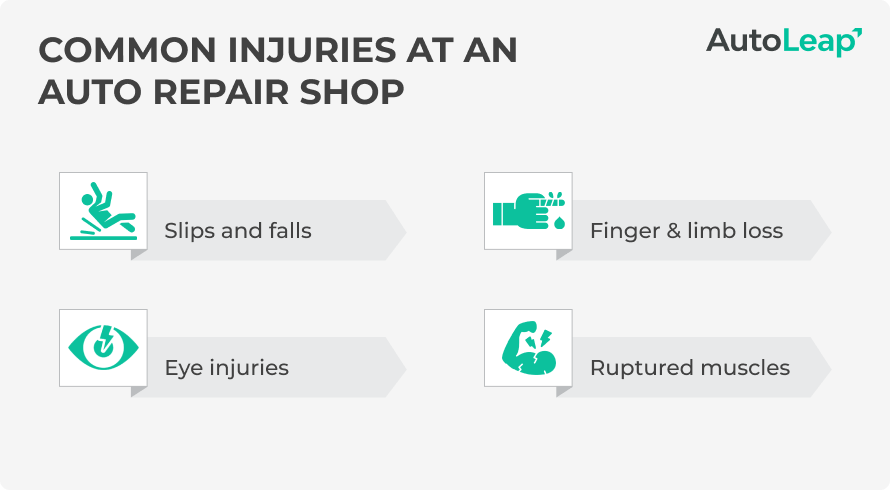

What are the 6 most important types of auto repair shop insurance?

Here are some types of auto shop insurance your auto business needs:

1. Worker’s compensation

The Workers’ Compensation Board defines workers’ compensation as “insurance that provides cash benefits and/or medical care for workers who are injured or become ill as a direct result of their job.”

This auto body shop insurance coverage is critical. These issues can occur despite how positive you feel about your business and its processes. According to the U.S. Bureau of Labor Statistics, over 9,900 nonfatal injuries and illness cases resulting in days off from work occurred in 2020 for automotive service technicians and mechanics in the private industry.

Protect your shop from complete financial liability if one of your technicians gets injured on the job. Covering hefty medical bills could derail any momentum your shop has built up.

2. Garage keeper’s insurance

Thimble defines garage keeper’s insurance as “a specialty policy that auto businesses use to protect client’s vehicles (cars, trucks, vans, motorcyles) that have been entrusted to the garage for service or repair.” The website cites numerous instances when this coverage would protect your shop and provide coverage for a customer’s car, such as damage from a sudden fire in the service bay or a stolen vehicle from your shop’s lot outside business hours.

With garage keeper’s insurance, your shop won’t be on the hook for expenses related to covered vehicle damage. Given the daily volume of vehicles your business works on, this is a no-brainer investment that protects your business and its bottom line.

3. General liability insurance

Nationwide defines general liability insurance as coverage for “medical expenses and attorney fees resulting from bodily injuries and property damage for which your company may be legally responsible.”

Consider this worst-case scenario. Your shop doesn’t have general liability coverage. One day, a customer slips on the slick floor in your waiting area and breaks their leg. An employee recently mopped the floor, but you didn’t have signage displayed to warn about that area. The customer sues your business, and you’re liable for their hospital bills and the lawsuit process.

General liability insurance can protect your shop in this instance. The investment will more than pay for itself if even one of these scenarios occurs at your business. Furthermore, there are additional steps you can take to prevent situations like our example. Check out our blog post on tips to optimize your shop’s layout for advice in this area.

4. Commercial property insurance

Nationwide defines commercial property insurance as coverage that “protects your company’s physical assets from fire, explosions, burst pipes, storms, theft and vandalism.”

Let’s face the unfortunate truth that one incident can impact the trajectory of your business forever. Unexpected scenarios will arise over many years, making coverage like commercial property insurance so important. Enjoy peace of mind knowing that your business is financially protected if one or more of these situations occur.

5. Loss of income insurance

Insurance accounting for emergencies is also available, covering both you as the shop owner and your team.

Nationwide defines loss-of-income insurance as coverage that “will help pay for specific continuing expenses that are covered under the policy, which could include payroll, taxes or mortgage payments.”

Take a flood example. Your shop is deemed inoperable for two months. That leaves your technicians, service advisors, and shop managers out of work for this period. If you meet the specific criteria with this coverage, you can cover that loss of income they accrue.

6. Commercial auto insurance

Travelers defines commercial auto insurance as “a business insurance policy that applies to autos owned by or used in your business that protects your business against liability for damages caused by accidents involving your business autos and provides certain compensation to occupants of your business autos injured in accidents.”

Maybe you allow your employee to take the business truck for a local community event or a related business errand. Unfortunately, your personal auto policy wouldn’t cover any liabilities if a collision or accident occurs. That’s where this essential policy coverage comes in. It’s worth considering if your shop uses company vehicles frequently for various tasks.

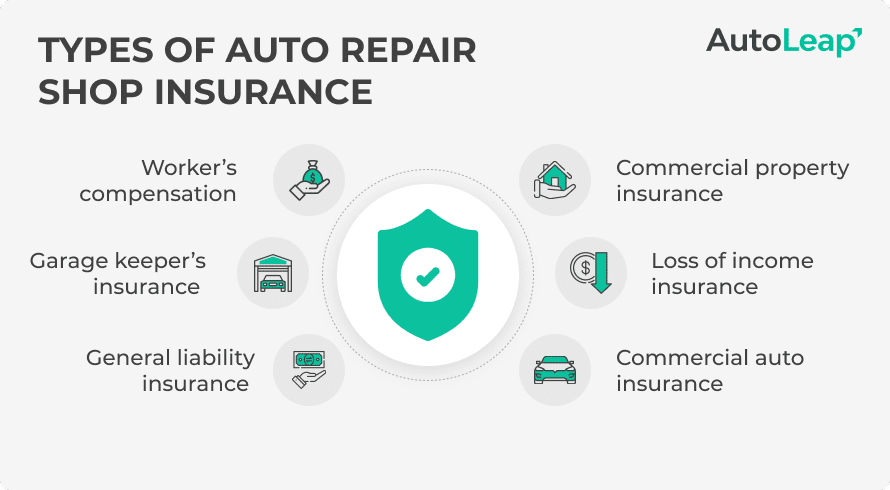

How much can you expect to spend?

The added liability protection might be tempting for most mechanics. Insurance cost, while it might be steep for small business owners, is worth the investment.

There are many companies offering different insurance plans with protection and rates that fit your shop’s needs. On average, a small auto repair shop pays a monthly sum of between $39 and $89 for insurance in the US; however, costs may vary depending on several factors.

Coverage cost varies by state—while some states don’t have mandatory requirements, California requires every auto repair business to cover some sort of insurance as part of the consumer protection law.

Here are some of the main factors that affect your auto repair business insurance cost:

Type of coverage

If you’re a small business owner, you may get away with getting the lowest-tier auto repair shop insurance. However, as you grow your auto repair business and more customers find their way to your shop, customer complaints are likely to increase, as do the chances of them suing you. For larger shops, a more comprehensive policy is recommended.

Insurance rates

While a reputable insurance company may seem more expensive than an unknown one, it’s also the safer bet. As a business owner, many independent insurance agents will approach you. It’s always a good idea to get multiple quotes from different vendors rather than accept the first cheapest estimate you find. There’s often room to bring down the initial estimate quote, so don’t be scared to bargain a little!

History of claims

If you’ve kept your business relatively out of trouble and don’t have too many past insurance claims, you may secure a good deal on insurance for your auto repair shop. Business insurance has a higher premium depending on how much risk factor is associated with your profile.

If, after conducting a risk assessment, the insurance company determines that they’ll have to give you frequent payouts, your premium will increase for the same insurance policy.

Total assets insured

Your business insurance premium changes based on how many assets you have covered under the policy. The more assets there are, the greater the sum you’ll have to pay.

It may be fun acquiring more repair shops in your region, but it significantly drives up your insurance expenses. Make sure you thoroughly understand your business insurance policy—especially property and equipment insurance when thinking about expanding your business.

Potential risk exposure for employees

Shops with more employees that work with heavy equipment will find themselves paying more to their insurance company since there’s a greater chance of injuries and payouts to technicians injured on the job. In shops where techs are often working on cars’ chassis or using grinders, it can drive up your auto mechanic insurance significantly.

Choosing the right business insurance for your auto repair shop

Each auto repair business is different, but thankfully there are multiple solutions available. Finding the right commercial property insurance is a reliable long-term investment and gives you peace of mind.

Just like choosing insurance, shop owners need the right technology to safeguard their operations and reputation. AutoLeap offers an all-in-one solution for shops of all sizes to improve operational efficiency and bring consistency in their daily workflows.

FAQs

What insurance do I need for a repair shop?

Your automotive repair shop insurance needs six types of insurance coverage, including:

- Worker’s compensation

- Garage keeper’s insurance

- General liability insurance

- Commercial property insurance

- Loss of income insurance

- Commercial auto insurance