Planning to open a tire shop but wondering what do you need to open a tire shop or do you need a license to open a tire shop? Don’t worry, we’ve got you covered!

Let’s break down all you need to know about tire shop licenses and the permits you need to launch a successful tire shop from day one.

Essential permits & licenses for your tire shop

So, how to open a tire shop? The permits and licenses required to open a tire shop depend on your location and the specific services you plan to offer. It’s important to research your local, state, and federal regulations. You can contact your local government or small business association directly to ensure compliance.

Here are some common permits and licenses that you will need to open a tire shop:

1. Business license

You will need a general business license from your local city or county government. This license allows you to operate a business within the jurisdiction. A business license is a fundamental requirement for operating a tire shop. It ensures you comply with legal, regulatory, and tax obligations while protecting consumers and the public interest.

Some important reasons for obtaining a business license are:

- Regulatory compliance: Different industries and business types may be subject to specific regulations to ensure public safety, environmental protection, and consumer rights. Specifically, your tire shop may be subject to environmental regulations due to handling used tires and hazardous tire service materials. A business license can indicate that you are aware of and comply with these regulations.

- Consumer protection: Licensing helps protect consumers by ensuring businesses adhere to certain quality and safety standards. In the case of a tire shop, it may indicate that you are qualified to sell and install tires, which can affect the safety of vehicles.

- Tax compliance: Business licenses often serve as a way for local governments to keep track of businesses and their tax obligations. Your license may get linked to various tax requirements, such as sales, property, and income taxes. That depends on the structure of your business.

- Professional credibility: Having a valid business license can enhance your professional credibility. It signals to customers, suppliers, and partners that you are a legitimate and serious business entity. This can be particularly important for building trust in your industry.

- Public records: Business licenses are often part of public records. That way, the public can verify your business’s legitimacy and access information about your business.

2. Seller’s permit/sales tax permit

A seller’s permit is a permit that gives a business the authorization to sell products and services within the jurisdiction granting the license.

In the United States, a seller’s permit, also known as a sales tax permit or sales tax license, is required for businesses that sell tangible goods. And that includes tires! Whether you need a seller’s permit for your tire shop depends on your state’s sales tax regulations.

Here are some key points to consider:

- State regulations: Sales tax regulations get determined at the state level. Each state has its own rules regarding sales tax collection, and these regulations can vary widely. Some states may require a seller’s permit for businesses that sell tires, while others may exempt specific types of sales or offer thresholds for small businesses.

- Tire sales and sales tax: Most states impose sales tax on the sale of tangible goods, including tires. If your state collects sales tax on tire sales, you will likely need a seller’s permit to collect and remit the tax.

- Application process: To obtain a seller’s permit, apply with your state’s taxing authority. The application process typically includes providing business information, such as your business name, address, and federal employer identification number (EIN). It may also require you to specify the types of goods you will sell, including tires.

- Tax collection and reporting: If you are required to have a seller’s permit, you will need to collect sales tax from customers at the time of the sale and report and remit that tax to the state at regular intervals (usually monthly, quarterly, or annually).

- Renewal: Seller’s permits typically need to be renewed periodically, and you may be required to update your permit if there are changes to your business, such as a change in location.

3. Employer identification number (EIN)

If you plan to have employees, you’ll need an EIN from the Internal Revenue Service (IRS) for the following reasons:

- Tax purposes: An EIN gets used primarily for tax-related matters. Even if you don’t have employees (as the name suggests), you may still need an EIN for your tire shop.

- Legal entity: It distinguishes your business as a separate legal entity from your personal identity, making it essential for tax purposes.

- Opening a business bank account: Most banks require an EIN when you want to open a business bank account.

- Applying for licenses and permits: When applying for various licenses and permits, including a business license, your state may require your EIN as part of the application process.

4. Zoning permit

Check local zoning regulations to ensure your chosen location will receive approval for a tire shop. Zoning regulations vary by area, so ensure your business complies with local land use regulations.

5. Environmental permit (for tire disposal and recycling)

Tire shops can generate waste, including used tires and chemicals. Depending on your location and services, you may need environmental permits to handle and dispose of hazardous materials. Environmental regulations vary, so consult with your state’s environmental agency.

6. Signage permit

If you plan to install signs or banners for your tire shop, you may need a permit for outdoor advertising. Sign regulations will vary by location.

7. Fire department permit

If you plan to store flammable materials, such as lubricants or solvents, or have fire concerns with specific tire equipment, you may need permits or inspections from the local fire department. This permit helps ensure fire safety compliance.

8. Health department permit (if offering general repair services)

If your tire shop offers additional services like car repair or maintenance, you may need permits from the local health department to ensure proper waste disposal and sanitation.

9. Occupational license (for the operation of specific equipment or services)

In some areas, you may need a special license or permit related to your occupation as a tire dealer or service provider. Check with your local licensing agency for specific requirements.

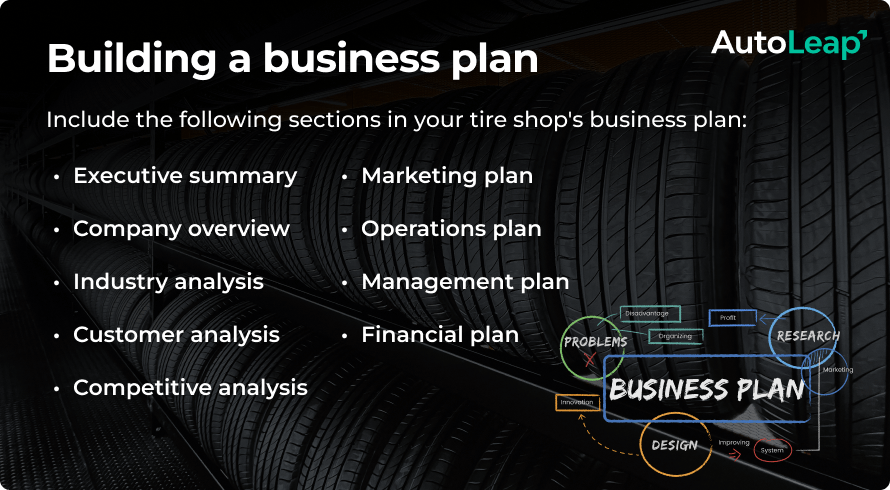

Why a business plan is important

A business plan will help you build a roadmap for your tire shop’s future success. It helps you outline what your vision is for achieving your business goals.

It should cover the following details:

- An executive summary

- Company overview

- Industry analysis

- Customer analysis

- Competitive analysis

- Marketing plan

- Operations plan

- Management team

- Financial plan

Why establishing a legal structure is crucial

One of the ways you can protect yourself from financial liability is by establishing a legal structure for your tire shop. LawDistrict defines a legal structure as “an organizational framework for how a business entity operates.”

Not only does it help your business seem more reliable for customers, but it also makes it easier to provide employee benefits.

Other advantages include:

- Legal protection

- Tax benefits

- Credibility

- Raising capital

- Ease of expansion

So what are some common legal structures you can consider for your tire shop? Let’s explore:

1. Sole proprietorship: As the name suggests, you will be the sole owner and control your tire shop.

Advantage: It’s easy, affordable and involves no paperwork.

Disadvantage: The biggest drawback is that the sole proprietor takes responsibility for the tire shop’s debts.

2. Partnership: Why go it alone when you can partner with a friend or corporation?

Advantage: A partnership is not only simple to form, but it also lowers your responsibility. Two heads are better than one!

Disadvantage: The disadvantage of a partnership is an increased risk of partner conflict. You won’t make sole decisions with this arrangement.

3. Limited liability company (LLC)

A limited liability company (or LLC) strikes a balance between sole proprietorship and a partnership.

Advantage: An LLC offers freedom, eliminates double taxation, and can restrict your personal liability.

Disadvantage: Forming an LLC may not be an option for your tire business depending on the state.

Closing thoughts

So here is your guide on how to start a tire shop. We hope this detailed overview helps you secure all the necessary permits and licenses to open your tire shop! Explore AutoLeap if you’re also in the market for tire shop management software to support your new business.

Frequently Asked Questions

How do I get more business at a tire shop?

Getting more business at a tire shop depends on how you execute marketing, provide high-quality customer service, and keep up with the latest industry trends.

What kind of costs are involved with opening a tire shop?

The cost of opening a tire shop will vary depending on the size of your business and its location. Legal and administrative expenses, equipment and supplies, staffing, your location rent or lease, insurance coverage, and marketing budgets will all factor into the total cost of your tire shop.