Setting up and making your auto repair shop profitable is no easy feat.

As an owner, you may soon turn your full attention to retirement. Or perhaps you’re thinking about other investment opportunities. Selling your business might help you get there.

But before you put your shop for sale, you need to figure out how much your mechanic shop is worth.

To help you get started, we need to focus on what goes into business valuation.

Schedule a free demo today!

Boost your shop sales

Simplify shop management

Empower your technicians

What you need to know

According to an industry expert in AutoLeap’s free Profit & Valuation eBook, the three most essential aspects of valuing your business are:

- Your owner’s pay

- Shop rent

- Net profit

These are tell-tale warning signs that you won’t be pleased with your shop’s overall valuation when it comes time to sell. Worse, you will struggle to take basic steps for your business moving forward. One example is securing a loan from a financial institution.

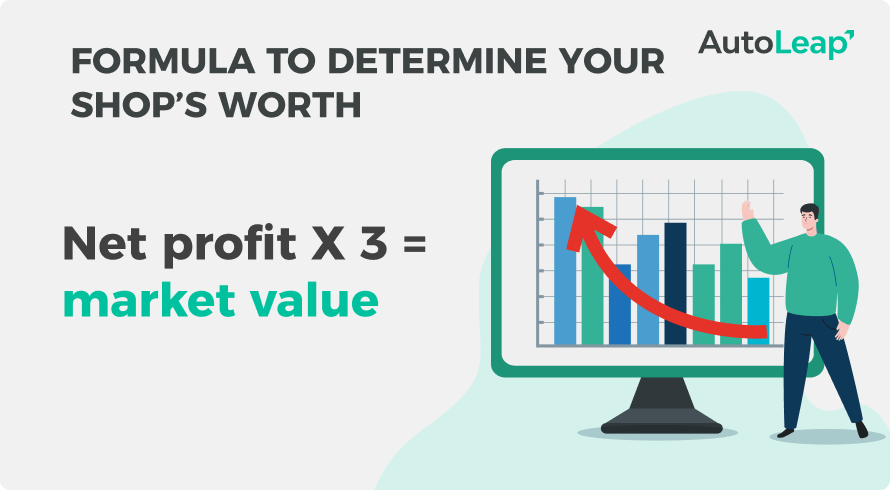

Use the following formula, cited in AutoLeap’s eBook, to determine what your business is worth:

Pro tip: An industry expert in AutoLeap’s eBook says property and tools aren’t your business. The real business is your customer base, your business name and the services you provide. Those are the real assets to focus on for valuing the business.

Advice

First things first, you could enlist a few professionals’ help. Consider speaking with the following people:

- A professional automotive business broker who has experience with sales in your market

- A banker or accountant, who will review your P&L and balance sheets

- A financial advisor

- A business valuation expert

» Want shop strategies for managing profits and cash flows? Click here to read our blog.

Each of these professionals will help you review your business’s current assets and financial standing. Use each piece of information to understand your auto repair shop’s value.

The valuation approach

Shop valuations aren’t a one-size-fits-all approach. There are many factors to account for, including:

- The market you operate in

- Your shop’s income

- The assets you own

Let’s break each down in detail.

1) Market valuation

CFI defines a market valuation approach as a “method used to determine the appraisal value of a business, intangible asset, business ownership interest, or security by considering the market prices of comparable assets or businesses that have been sold recently or those that are still available.” The website cites common examples that fall under this category, including a business’s sales.

How does your shop size up against competing auto repair businesses? You won’t be able to review their income statements and financial records. But you can do some simple math based on their services and pricing. Evaluate your competition in this manner to better understand your shop’s actual value in the marketplace.

2) Income valuation

Investopedia defines an income approach as “a type of real estate appraisal method that allows investors to estimate the value of a property based on the income the property generates.” Investopedia’s formula for this is your shop’s net operating income (NOI) of the rent collected divided by the capitalization rate.

Sounds complex, right? But the more significant point remains that potential investors will value your shop using these equations. That means you should start using them, too! Consider your shop’s valuation in numbers. Learn formulas like these. If the percentages could be more appealing, focus on critical areas where you can turn that valuation around.

3) Asset valuation

Investopedia defines an asset-based approach as a “type of business valuation that focuses on a company’s net asset value.” Investopedia’s formula for this is subtracting your shop’s total liabilities from its assets.

It’s similar to how you can determine your net worth with personal financing. Take the time to gather your list of your shop’s total assets. Those may include your property, equipment, and tools. Then, compile your total liabilities — factor in any loans or outstanding money you owe.

Complete this evaluation process regularly to ensure you understand your shop’s valuation from an asset perspective. Then, work to increase your list of assets and decrease your list of liabilities.

How to complete your shop evaluation process

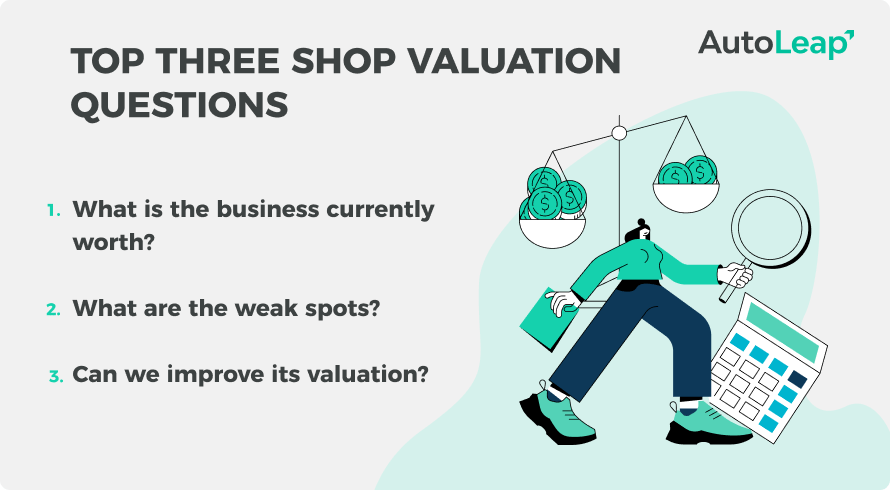

Once your business is valued with these expert insights and market approach, you can turn your attention to these three questions:

You can critique and improve weak spots based on these answers. Some suggestions include:

- Hiring a shop coach

- Researching industry articles on the topic

- Listening to informative podcasts

- Visiting and networking at popular industry shows

The more exposure you give yourself, the more you will learn. This shop valuation topic is complex with many moving parts. Information can only help!

Finding a buyer for your shop

You’ve completed the valuation process, made improvements, and thought it over some more. It’s time. You’re ready to sell your auto repair shop. But what now?

You can consult this advisor to help complete some of our following insights or complete the process independently. Regardless, you’ll want to find a reliable partner to bounce your potential decisions off of. Maybe you’re friends with a shop owner who recently sold their business. Or you’re part of an association with a strong network and experience in this area. Consult these resources before you make any significant decision!

Tap into your network

Your network isn’t just there for advice on how to move forward. They may be in the market for a potential purchase!

Fellow shop owners are a great option here. When you’re ready to sell, approach any owners you’re friendly with. They may be prepared for a multi-location expansion, and it’s the perfect time to connect! Complete this word-of-mouth process with other interested parties you trust before moving to other approaches.

Promote your plans

Are you not landing many hits in your referral network? It’s time to spread the word further! The world needs to know that your business is for sale. Consider running digital marketing campaigns to get this message in front of the right audience.

Get your documents in order

Selling your shop will require a lot, and we mean a lot, of paperwork. You must ensure a financial advisor thoroughly vets this documentation and is good to go when a potential sale goes through. The last thing you want is for glaring mistakes to come to light during the negotiation process. Those inconsistencies can bring you right back to square one.

Focus on fair value

You worked hard for so many years to build something special. That’s why you deserve fair value for the shop you’ve poured your heart and soul into.

Take your time with the negotiation process. Lean on your financial advisor to clarify questions, but make sure your input comes first. Don’t settle for less than what you’ve valued the business at. And be determined to walk away if the offer just isn’t right.

» Want shop strategies for managing profits and cash flows? Click here to read our blog.

Wrapping up

Shop valuations aren’t easy. However, a thorough process with good support from professionals can get you the best possible sale price you can find.

Use the tips from this blog post to get that process on the right track.

Frequently Asked Questions

Are auto repair shops profitable?

If you offer the right services with a good hourly/flat rate, your auto repair shop can definitely be profitable.

How do I run a successful auto repair shop?

To run a successful auto repair business, be sure to offer the most profitable auto repair services, invest in estimating software and provide good customer service.

Is a mechanic shop a good investment?

With a projected auto industry revenue at $58.7 billion by 2024, mechanic shops are a worthwhile investment.